https://finintegrity.org/wp-content/uploads/2026/02/article-compliance-training-as-a-strategic-control.jpg

1000

1500

IFI

https://live-black-pebble.pantheonsite.io/wp-content/uploads/2023/12/GIFI-Placeholder2.png

IFI2026-03-05 07:00:052026-03-03 10:27:35Compliance Training as a Strategic Control

https://finintegrity.org/wp-content/uploads/2026/02/article-compliance-training-as-a-strategic-control.jpg

1000

1500

IFI

https://live-black-pebble.pantheonsite.io/wp-content/uploads/2023/12/GIFI-Placeholder2.png

IFI2026-03-05 07:00:052026-03-03 10:27:35Compliance Training as a Strategic Control https://finintegrity.org/wp-content/uploads/2026/02/article-compliance-training-as-a-strategic-control.jpg

1000

1500

IFI

https://live-black-pebble.pantheonsite.io/wp-content/uploads/2023/12/GIFI-Placeholder2.png

IFI2026-03-05 07:00:052026-03-03 10:27:35Compliance Training as a Strategic Control

https://finintegrity.org/wp-content/uploads/2026/02/article-compliance-training-as-a-strategic-control.jpg

1000

1500

IFI

https://live-black-pebble.pantheonsite.io/wp-content/uploads/2023/12/GIFI-Placeholder2.png

IFI2026-03-05 07:00:052026-03-03 10:27:35Compliance Training as a Strategic Control

February 2026 Monthly Sanctions and Export Controls Report

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from February 2026.

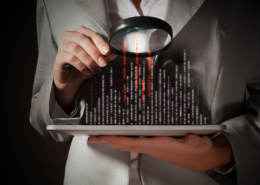

What Effective Compliance Training Looks Like

Custom compliance training is often misunderstood as light tailoring. This article explains what real customization looks like in practice, from risk-aligned content and role-specific learning to training built around real decisions, controls, and regulatory expectations.

Why and How Standardized Training Falls Short

Today’s financial institutions operate across different products, jurisdictions, and threat environments. This article examines why standardized training falls short and where generic programs consistently break down in practice.

Wynn or Lose

Casinos have long been associated with money laundering and organized crime. Explore the recent Wynn Las Vegas $130 million forfeiture as a case study, including threats such as Chinese Money Laundering Networks, mirror transfers, proxy gambling, and the use of shell companies.

Electronic Fund Transfer Consumer Protection

The Electronic Fund Transfer Act (EFTA) was established to protect consumers using electronic fund transfers. Explore what is considered in scope and the changes proposed to include crypto.

January 2026 Monthly Sanctions and Export Controls Report

There were several major sanctions-related developments in January, most notably the U.S.’s easing of sanctions to facilitate Venezuelan oil sales and the ratcheting up of western sanctions in response to Tehran’s violent crackdown on protestors, among others.

Following the Illicit Funds

As crypto grows, so does regulatory oversight. From SARs and CTRs to MSB registration and potential FBAR requirements, crypto businesses are now firmly within the scope of financial regulations.

Blind Spots in the System

When transaction monitoring fails, the cost goes far beyond fines. This article explores why many programs still miss critical red flags and how effective training helps teams to strengthen detection, calibration, and oversight where it matters most.

Top 10: Cartel Finance & Chinese Money Laundering Networks

The Institute for Financial Integrity has identified the “Top 10” list of actionable resources for financial institutions to use to detect and respond to cartel finance and CMLNs. These can inform policies, processes, systems, controls, and training programs.

Synthetic Identities

Fraud generates billions in proceeds every year, and the use of AI significantly increases the speed, scale, and likelihood of success. Synthetic identities are already leveraged to open accounts used to commit fraud and launder money. Explore red flags and actions financial institutions must take to detect and respond to AI-enabled synthetic identities.

December 2025 Monthly Sanctions and Export Controls Report

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from December 2025.

The Use of Secondary Sanctions

Secondary sanctions extend the reach of a country’s regulatory authority to foreign individuals and entities with no direct connection to the sanctioning country.

AML/CFT and Sanctions Enforcement Actions in 2025

2025 will go down as a historic year for AML/CFT and sanctions-related enforcement actions in two ways. It’s the first time in over 20 years that no banks have faced major penalties, and state regulators began jointly penalizing institutions.

Debt & Duty

Chinese Money Laundering Networks target students to operate as money mules to launder cartel proceeds. Learn more about the methods used for recruitment and control, and the red flags that financial institutions can use to identify and respond.

November 2025 Sanctions and Export Controls Update

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from November 2025.

When Holiday Cheer Meets Fraud Pressure

This article breaks down the key scam patterns emerging this season, why December has become a true test of institutional readiness, and the steps teams can take to reduce losses and respond with confidence.

Where Boards and Senior Management Fall Short on Compliance Oversight

From passive oversight and overreliance on compliance officers to blind spots in risk awareness and a check-the-box only training culture, senior management often stumbles in ways that invite regulatory scrutiny. This article explores the most common pitfalls and how leaders can avoid them to strengthen accountability at the top.

OFAC’s 50 Percent Rule

This article delves into OFAC’s 50 Percent Rule, common pitfalls, and best practices for avoiding costly mistakes.

October 2025 Sanctions and Export Controls Update

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from Ocotober 2025.

Phantom Risks

As financial crime compliance teams rely increasingly on automation, unseen vulnerabilities often hide in plain sight. This article examines the “phantom risks” modern CCOs face—from AI-driven fraud to overlooked vendor gaps—and how to bring them into the light before they strike.

Navigating the Convergence of Sanctions Evasion, Export Control Evasion, and Money Laundering

Explore the convergence of illicit finance domains through real-life examples including Russia’s procurement of drone components, Iran’s evasion networks, and China’s acquisition of restricted chips.

The Illusion of Preparedness

High training completion rates may look good on paper, but they don’t always mean teams are ready for real-world threats. Explore why even well-trained staff can miss critical red flags—and what leaders can do to turn perceived readiness into proven preparedness.

Operation Mouse

Synthetic identities are increasingly used to perpetrate fraud. Delve into real-life examples of synthetic identity fraud in Canada, along with the actions financial institutions can take in response, in this article.

The BIS 50% Rule

Under the new BIS Affiliates Rule, any entity at least 50% owned by a listed party is subject to the same export control restrictions as the parent. The objective of the rule is to close a loophole and more effectively counter diversion of sensitive and restricted items.

September 2025 Sanctions and Export Controls Update

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from September 2025.

The Rising Standard

This article explores why oversight matters more than ever, how accountability is evolving, and what boards can do to meet rising expectations.

Laundering Luxury

‘Daigou’ buyers purchasing luxury items in the U.S. for sale in China are often funded by Chinese Money Laundering Networks using financial proceeds of cartel activities. Learn how these methods operate, the red flags financial institutions can identify, and the actions to take in response.

Terrorist Drug Trafficking Organizations

This article provides background on designated cartels — their geographic reach, how they raise and move money, the risks they pose to financial institutions, and common red flags that may help financial institutions to identify suspicious activity.

FATF’s Recent Risk Map Update

FATF’s June 2025 update—new grey list additions and unchanged high-risk jurisdictions mean updated risk scores, stronger due diligence, and sharper monitoring for compliance teams. Here are three actions to take now.

August 2025 Sanctions and Export Controls Update

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from August 2025.

Deepfake Deep Dive

Artificial intelligence (AI) can increase the volume, value, and effectiveness of fraud attacks such as CEO fraud. Financial institutions should take action to protect themselves – and their customers.

From Outdated to Aligned

Modern compliance risks require modern training. Discover how forward-thinking institutions are reshaping their programs to stay ahead of fast-evolving threats.

Training for the Wrong Risk

Many teams are completing training—but on outdated risks. This article explores how misaligned training leaves organizations exposed, and what leaders can do to close the gap.

July 2025 Sanctions and Export Controls Update

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from July 2025.

Blockchain & Ballistics

The Houthis are pioneering a new model of terrorist financing by using digital assets to purchase advanced weapons systems. This article explores the new dimensions of this convergence, and red flags associated with these evolving risks.

Out of the Shadows

Iran’s shadow banking system has laundered billions of dollars for the regime. In this article, we detail how the system works and how financial institutions can identify red flags associated with Iran’s oil smuggling and concealed payment networks.

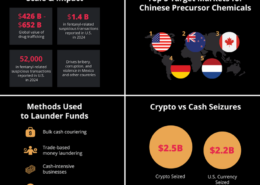

Cartels & Crypto

Cartels and the professional money launderers that service them have integrated digital assets throughout the narcotics trade, from precursors to sales and laundering proceeds.

A Necessary Shift in Mindset

In this article, we explore how financial institutions can transform training from a cost center into a strategic tool for managing risk, strengthening culture, and staying ahead of regulators.

Canada’s Strong Borders Act

Canada’s Strong Borders Act represents a sweeping overhaul of the country’s AML/CFT regime. The legislation introduces tougher penalties, expanded oversight, and stricter compliance and enforcement expectations.

June 2025 Sanctions & Export Controls Update

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from June 2025.

A Dangerous Alliance

Today, on United Nations International Day Against Drug Abuse and Illicit Trafficking, we spotlight a dangerous financial alliance accelerating the fentanyl crisis: transnational partnerships between Mexican cartels and Chinese money laundering networks.

From Fraud to Flow

Fraud is often the entry point into a complex web of financial crime from money laundering to terrorism financing. Understanding this gateway role is essential for those defending the integrity of the global financial system.

Optimizing Effectiveness

In this article, we explore what effective training really looks like—customized, engaging, and aligned with today’s regulatory environment.

The Network, Not the Node

Data analytics and advanced technologies are critical tools to take effective action against increasingly complex criminal networks. In this article we consider the best practices a financial institution could apply when implementing data analytics strategies and solutions, and what the future holds.

May 2025 Sanctions & Export Controls Update

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from the U.S., EU and UK in May 2025.

Lessons From Russia & Iran – What EU Sanctions Teach Us About Policy in Action

The EU’s Russia and Iran sanctions programs demonstrate using sanctions as strategic tools of influence, while also exposing the challenges in enforcement and importance of global coordination.

Why Compliance Training Still Fails

Even with mandatory training, financial institutions continue to face major compliance failures. This article unpacks the risks of a “check-the-box” culture—and why outdated, generic programs aren’t enough to keep your organization compliant.

Trump’s IEEPA Tariffs – Blurring the Lines Between Trade Sanctions and Traditional Tariffs

The Trump administration’s unprecedented use of tariffs as a tool of national security and foreign policy to compel countries to change policies the U.S. opposes has blurred the lines between tariffs and trade sanctions.

Recent IAR Enforcement Actions

Recent SEC enforcement actions against IARs highlight critical compliance failures, including unregistered brokerage activities, misleading marketing practices, undisclosed conflicts of interest, and inadequate compliance policies.

April 2025 Sanctions & Export Controls Update

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from the U.S., EU and UK in April 2025.

Sweeping AML Requirements for RIAs and ERAs

FINCEN issued a final rule with new AML requirements for investment advisers. With the January 1, 2026 deadline approaching, RIA and ERA firms must begin building and implementing their compliance programs as soon as possible.

When Less is More

Microlearning – meaning knowledge or training divided into small learning objects – offers many advantages. In this article, we consider the types of microlearning, best practices for implementation, and examples of how this works well in compliance.

Cartels, Cash, and Capital Flows

Cartels and their money laundering networks represent an increasing threat to our security and citizens, as well as being a priority for enforcement action. This article sets out five actionable steps a financial institution can take to ensure it is effectively identifying and responding to cartel risk.

Intensifying Focus on Export Control Compliance by Banks

This article recaps BIS export control guidance to banks, assesses the likelihood of enforcement action this year, and sets out actions Chief Compliance Officers can take to improve their export control compliance program.

AI vs. Human Judgment

AI is helping financial institutions stay on top of their game while making processes faster and more efficient. But with recent advancements, one question keeps coming up: Will AI replace compliance professionals? In this article, we explore where AI excels versus human judgment.

Syndicates of Terror

Eight Latin American drug cartels were recently designated by the United States as Foreign Terrorist Organizations and Specially Designated Global Terrorists. The U.S. designation enhances compliance risks for financial institutions and other companies transacting in Latin America.

Export Controls, Ethics & Human Rights in Global Trade

International trade is vital for economic growth and global relations, but it involves complex ethical and legal issues, especially regarding human rights. Explore dual use goods, human rights considerations, international regulatory frameworks, and actions for businesses further in this article.

Lifting Sanctions on Syria

Human rights activists have been advocating for the lifting of sanctions to help Syria rebuild after nearly 14 years of destruction. What would U.S. sanctions relief for Syria entail? What changes will likely be required?

Advancement in Digital Asset Markets

Review policies and regulation on crypto in the U.S., UK, EU, and globally, how this influences adoption, and measures to capitalize on rewards while managing illicit finance risks.

False Flags, Fake Docs, and Fraudulent Routes

Russia continues to evade the $60 per-barrel price cap on its seaborne oil shipments. What can financial institutions engaged in documentary trade in the energy sector and other industry stakeholders do to mitigate their risks?

Untangling the Threads of Global Economic Tools

Ever wonder how export controls, sanctions, and proliferation finance differ—and why it matters? This article breaks down these essential tools, explains their unique purposes, and highlights how they often overlap in the real world.

Navigating the Convergence of Sanctions & AML Regimes

In our recent webinar, the director of compliance and enforcement at OFAC and three financial integrity industry leaders discussed the importance of breaking down silos and shared other advice for AML/CFT and sanctions professionals.

Russia: Slew of Sanctions

Explore the highlights from our most recent webinar about Russia sanctions. What happened in 2024, how has the regulatory atmosphere changed, and how will the sanctions environment evolve in 2025?

Interlocking Action

Transnational crime requires a coordinated response. Examine the characteristics of transnational crime, breakdowns in internal cooperation within financial institutions that resulted in enforcement action, and the actions Chief Compliance Officers must take to ensure an effective and coordinated response within their institution.

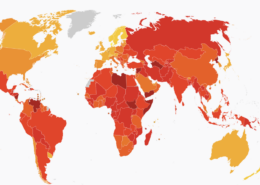

The Heat is On

Explore the key insights and implications from Transparency International’s 2024 Corruption Perceptions Index.

Lighting Up the Darknet

The validity of blockchain analytics technology was assessed in the Bitcoin Fog money laundering trial. What lessons does the Court’s reasoning have for Chief Compliance Officer using blockchain analytics and other decision support technologies?

Walking the Sanctions Tightrope

In today’s fast-evolving regulatory landscape, sanctions compliance can feel like an uphill battle. This guide explores the key challenges compliance officers face—ranging from multi-jurisdictional rules to cryptocurrency complexities—and offers practical tips to stay ahead.

The New Counter-Illicit Finance Regime

The convergence of AML/CFT and sanctions regimes has led to a paradigm shift. These disciplines may now be viewed as overlapping parts of a broader global counter-illicit finance regime.

Examining Evasion

Explore three recent examples with Russia, Iran, and North Korea, which represent some of the most common methods illicit actors have embraced to evade sanctions. Understanding them is an important starting point for private sector firms in assessing and responding to their exposure.

Wicked Games

Casinos are a convenient money-laundering venue. Discover effective strategies gaming venues can use to structure a robust AML compliance program and avoid being exploited by illicit actors.

Biden Takes Final Shot at Russia’s Energy

The Biden administration on January 10, 2025, imposed the most severe sanctions on Russia’s energy sector since the start of Russia’s full-scale invasion of Ukraine. What should financial institutions and other firms know about these new designations, and how can they mitigate their risks?

The Chips Are Down

Recent enforcement actions indicate regulators are tightening their focus on the illicit cash that traverses the gaming industry. This article explores why casinos are a convenient money laundering venue and recent enforcement cases that highlight the risks the gaming industry faces globally.

2024’s Top 10 Major Developments

Explore the highlights from our recent webinar including an overview of the current illicit finance landscape, major events in 2024 as well as noted possible future developments as the global illicit finance regime grows and evolves.

Syria Sanctions Relief

The U.S. Treasury has issued a Syria General License to provide gradual sanctions relief for the Syrian people after the regime of Bashar al-Assad was toppled in December 2024. What does this sanctions relief mean to financial institutions and other firms hoping to transact in the country?

The Green Gold Rush

Explore the corruption risks in the green transition mining and minerals sector, a rapidly growing industry fraught with challenges that expose businesses to bribery, fraud, and reputational damage. Discover strategies to protect your operations and ensure compliance in the race for sustainable energy solutions.

Shell Companies as an Enabler of Export Control Violations

Shell companies are a key enabler of export control violations, which represents an extension of their well-established use in other financial crimes. This article provides red flags financial institutions can use to identify shell companies in the export control context and to take action accordingly – which can provide one element in an export control compliance program.

Lessons from the Frontlines of AI in Compliance

Explore how financial institutions can leverage gen AI responsibly through strategies that prioritize data quality, transparency, user education, and ongoing testing.

Sanctions in 2024: Global Pressure Points in the UN, U.S., EU, and UK

In 2024, the UN, U.S., EU, and UK ramped up sanctions targeting Russia, Iran, and conflict zones, focusing on critical sectors like energy, defense, and technology. In this article, we explore these coordinated efforts aimed at weakening adversarial regimes while navigating complex compliance and humanitarian challenges.

Toward a Financial Integrity Risk Management Program

This article explores the commonalities between AML, sanctions compliance, ABC, fraud risk management, and export control compliance programs and recommends that organizations consider using a holistic financial integrity risk management and compliance framework.

Safeguarding Trust – How to Balance Innovation and Security in Gen AI-Powered Compliance

This article explores how privacy-first architecture, robust guardrails, and source transparency can build trust while ensuring responsible AI deployment in compliance solutions.

Webinar Recap – The Dos, Don’ts & Expert Insights on Beneficial Ownership

In our recent webinar, regulatory, investigative, and anticorruption policy experts discussed some of the nuances relating to the U.S. Corporate Transparency Act (CTA) and its Beneficial Ownership reporting requirement. Explore the highlights in this article.

A Tipping Point

Learn how gen-AI is reshaping the industry and how tools like AskFIN, IFI’s gen-AI-powered financial crime assistant, are leveraging authoritative resources and privacy-first architecture to drive meaningful innovation.

Cold Turkey

Consumer spending over the holiday season is expected to top $1.66 trillion this year in the U.S. alone. This article describes five holiday season frauds to be aware of along with associated red flags to avoid being scammed.

The Sanctions Evasion Threat

It’s more important than ever for compliance officers to understand and recognize sanctions evasion typologies. In this article, we explore six of the most common techniques illicit actors use to evade sanctions.

How to be a Digital Asset Detective

Step into the role of a digital asset investigator. From tracing complex ownership structures to leveraging blockchain transparency, discover the tools and techniques that bring clarity to a sector often seen as cryptic. Follow along with our investigation into a digital asset business and come away with a step-by-step guide for uncovering hidden risks.

Side Quest

“Side quests” are initiatives that align staff motivations, interests, and experience with discretionary projects. They provide solutions to enhance staff engagement, performance, and retention, and are particularly valuable where resource constraints may slow promotions or pay increases, or where compliance tasks involve repetitive work.

Calibrating the Crosshairs

This article outlines a practical six-step process financial institutions can follow to implement export control red flags within their compliance program. They are referenced as a key requirement in regulatory expectations of financial institutions, which continue to increase in response to recent geopolitical events.

Unverified and Unsure

The Commerce Department’s Bureau of Industry and Security maintains and administers several lists that involve goods, software, and technology, governed by the Export Administration Regulations. The Unverified List is just one of these. What is the Unverified List and what due diligence obligations do entities that transact with parties on the Unverified List have?

Onerous Ownership

New U.S. beneficial ownership reporting requirements went into effect on January 1, 2024, obliging many small businesses to report to FinCEN identifying information about the individuals who directly or indirectly own or control 25% or more of the company. This article explores what you need to know as well as concerns company owners have expressed about the privacy, security, and regulatory scrutiny that accompanies the new regulations.

Big Fines, Bigger Lessons

TD Bank’s $3 billion fine highlights a growing trend: regulators are cracking down hard on weak AML programs. Discover why fines are skyrocketing and how strong AML training can help safeguard your institution.

Risky Convergences

New digital solutions in money laundering and underground banking have facilitated the expansion of the criminal business environment in Southeast Asia, integrate billions of criminal proceeds into the formal financial system and enabling the growth of new criminal organizations.

A PEP Talk

Politically exposed persons are individuals who, due to their positions of power, influence, or proximity to government, are susceptible to becoming involved in corruption, bribery, or other financial crimes. And because moving and hiding misappropriated assets often involves money laundering, financial institutions across the globe are tasked with the challenge of identifying and managing these risks.

A $3 Billion Mistake

TD Bank was recently slammed with a record $3 billion fine for failing to comply with AML laws. With $18 trillion in unmonitored transactions, the bank became a hotbed for criminal activity. What went wrong, and what can other financial institutions learn from this?

Beneficial Ownership: Who Owns What?

U.S. efforts to curb illicit finance are in full swing, as the requirement to reveal the beneficial owners of certain entities registered or operating in the United States came into effect this year. In this article, we explore key requirements, benefits, and deadlines as well as address some of the concerns organizations may have about the new regulation.

New BIS Export Compliance Guidance for Financial Institutions

The U.S. Bureau of Industry and Security recently published guidance for financial institutions on complying with strategic trade controls and discussing best practices, red flags, screening, and reporting. The latest guidance provides greater detail on due diligence and risk management to help financial institutions detect and deter emerging and evolving export controls evasion.

From Cash to Clicks – AML Challenges & Typologies for Digital Payments

Dive into the dynamic world of digital payments, where convenience meets innovation. Learn the challenges Payment Service Providers are navigating with smarter, technology-driven Anti-Money Laundering practices to ensure secure and efficient transactions.

Exploring the Balance of Innovation & Responsibility

In our recent webinar, industry leaders examined the intricacies of leveraging AI responsibly to enhance compliance strategies while safeguarding data privacy and ethics. Featuring a panel of industry experts including Shannon Barnes, Ajit Tharaken, and Catherine Woods, this blog post summarizes the key insights shared during the event.

The Risks of De-Risking

Compliance officers are guardians at the gate: protecting their organization and the global financial system from abuse while also ensuring that licit funds flow undisturbed. This is a delicate balance, as global regulations continue to grow in complexity, prompting some financial institutions to de-risk from high-risk clients. What are high-risk clients? Must a bank cease its relationships with these clients?

How has Terrorism Financing Changed Since 9/11?

While financial provisions enacted after the terrorist attacks of 9/11 have succeeded in addressing vulnerabilities in the global financial system, terrorist organizations have developed new methods of fundraising and moving assets, including digital assets and online platforms. In this article we examine how new technologies facilitate terrorism financing and the risks financial institutions should consider.

A Review of the Financial System Post 9/11

After the terrorist attacks on September 11, 2001, the private sector, especially financial institutions, began to play a vital part in protecting the U.S. and global financial systems. In this article we examine the changes to the financial system that resulted after 9/11 and discuss how the role of financial institutions has changed with respect to deterring and detecting the financing of terrorism.

AML Compliance for Small Businesses

Small businesses face the challenge of navigating the intricate landscape of anti-money laundering (AML) regulations. Despite the challenges posed by evolving global standards and limited resources, small businesses can use tailored strategies to fortify their compliance frameworks and thrive in a complex regulatory environment.

The Ghost in the Shell

Shell companies, meaning businesses that have a legal structure but no real operations or assets, have been used extensively in money laundering, proliferation finance, sanctions evasion, tax evasion, and other types of financial crimes. There is now evidence that shell companies are increasingly being used for strategic trade control violations too. This is good news for financial institutions: existing controls designed to detect the misuse of shell companies for other financial crimes will catch export control-related activity in their net too – but some adaptations are required.

Collaboration Between Chinese Money Laundering Organizations & Drug Cartels

Global regulators are highlighting the growing threat of Chinese money laundering organizations that help transnational criminal organizations—particularly drug cartels—access and move assets through the global financial system. Global financial institutions must enhance their due diligence efforts, given the growing scope of the problem and the increasingly sophisticated methods used to launder drug proceeds.

Elevating Defenses

Dive into the cutting-edge strategies that financial institutions are implementing to combat the evolving threat of AI-driven fraud. From deploying advanced detection technologies to fostering robust networks of allies, learn how the financial sector is bolstering its defenses against sophisticated scams like deepfakes and biometric fraud.

Deepfakes and Dollars

While AI has the potential for transformative impact in the financial sector, it also introduces new challenges. From biometric mimicry to the alarming rise of deepfakes, this blog highlights emerging threats and challenges in countering AI-driven fraud.

Lessons from the Flight Deck

Automation and artificial intelligence, including machine learning, have the potential to provide significant benefits within financial services – however they must be implemented responsibly. In this article, we draw on the use of automation in other sectors such as aviation, review key global regulations, and examine regulatory enforcement actions, to identify best practices for responsible use of AI in compliance.

Adapting to Digital Assets Risks

In our recent webinar, "Mastering Compliance in Digital Assets through Multi-Tiered Defense Strategies," industry leaders examined the intricacies of digital asset compliance. Featuring a panel of industry experts including Andrew Rosenberg, Elizabeth Severinovskaya, and Catherine Woods, this blog post summarizes the key insights shared during the event.

Working Together to Fight Transnational Financial Crime

The transnational nature of criminal networks, cross-border financial flows, and sometimes the international nature of crimes themselves, mean a unified response between the public, private sector, and “third sector” is critical. This article uses the example of human trafficking to identify the capabilities of each sector and how they can achieve the greatest effect by working together.

The Convergence of Sanctions & AML

The convergence of sanctions and anti-money laundering efforts has significantly accelerated since Russia’s full-scale invasion of Ukraine in February 2022. FINTRAC in June 2024 released a special bulletin focusing on financial activity associated with suspected sanctions evasion. The report highlighted shared methodologies and insights to help compliance teams collaborate on best practices.

Three Lines of Defense: Case Study

The “three lines of defense” model is a widely recognized approach for effectively managing financial crime and regulatory risk. But how does it work in practice? This article explores how the three lines of defense applies using client due diligence as a real-life case study.

Targeting Russia’s IT Dependencies

Delve into the recent determination issued by OFAC, which imposes significant additional restrictions on the provision to Russia of IT consultancy and design services as well as IT support and cloud-based services of enterprise management and design and manufacturing software. Multinational tech corporations, financial institutions, and other companies still operating in Russia will likely require licenses to continue operating there.

Crypto Under the Microscope

In the fast-evolving digital assets market, compliance is not just a regulatory requirement—it's a strategic imperative. From Binance's multi-billion-dollar settlement to the dramatic collapse of FTX, recent enforcement actions have sent shockwaves through the industry, underscoring the critical need for a robust compliance system.

Three Lines of Defense

The “three lines of defense” is a well-established model for implementing an organizational structure to effectively manage financial crime risk and regulatory compliance. Explore the three lines of defense, their responsibilities and the advantages of the three line model in this article.

Understanding and Addressing Fraud and Corruption Risks

In our recent webinar, industry experts delved into the crucial topic of fraud and corruption risks. From seasoned professionals to anti-corruption activists, the webinar featured a panel of distinguished speakers: Steve Burgess, Nikki Kenyon, Chris Williams, and James Wasserstrom. This blog post aims to summarize the key points discussed during the session, equipping readers with the knowledge necessary to navigate these risks effectively.

Embracing Emerging Technologies through Capability Development

Risk is perceived to be higher when a subject area is unfamiliar, which is particularly likely for emerging technologies and products. One solution is to develop the capability of staff through training and experience, where Chief Compliance Officers can utilize partners to support upskilling and augment internal capability where required. Digital assets provide a good case study: detailed knowledge within financial institution compliance and business teams to manage risks while enabling business growth.

Corruption in Construction

Corruption in the construction sector can include everything from fraud, to extortion, embezzlement, and other abuses. Corruption doesn’t just undermine good governance; it endangers lives and threatens the reputation of any financial institution involved in construction projects that are rife with fraud and abuse. How can government organizations and financial institutions mitigate corruption risks when funding or supporting infrastructure projects? How can they detect suspicious transactions?

OFAC’s Compliance Guidance in Action

The Treasury Department’s Office of Foreign Assets Control (OFAC) five years ago published its Framework for OFAC Compliance Commitments. This guidance remains the most comprehensive articulation of OFAC’s compliance expectations to date. Although it notably stopped short of mandating a sanctions compliance program (SCP), recent enforcement actions demonstrate the implications of not having an SCP in place.

Corruption Kills

Construction projects are especially vulnerable to corruption because of their complexity, high price tags, and the number of intermediaries and other parties involved. Corruption in the construction sector does not merely result in financial losses, environmental destruction, and inequality, but it can also result in loss of life.

FinCEN Issues Warning to Financial Institutions

Iran continues to explore techniques that allow it to move funds to terrorist proxy groups in its efforts to destabilize the Middle East and project power by supporting the global operations of dangerous militias, proliferation of weapons, and malicious cyber activities. Financial institutions must be increasingly vigilant in detecting illicit transactions linked to Iran-backed terrorist organizations. Regulators have providing guidance, including red flags, and highlighting methodologies used by terrorist groups to raise funds.

Tech vs. Corruption

As corruption continues to pose significant challenges across various sectors, including government agencies, traditional banking institutions, and designated non-financial businesses and professionals (DNFBPs), innovative technological solutions are proving to be essential in combating these issues. This article highlights how blockchain, AI, and data analytics are revolutionizing the fight against corruption.

Types of Sanctions – A Vast and Varying Landscape

In the United States, most sanctions programs combine multiple types of designations that vary across multiple dimensions. U.S. designations are constantly changing, and more individuals, entities, vessels, and aircraft are being added to OFAC’s sanctions list. Explore the five primary types of sanctions in our latest article.

Upholding Integrity — Obligations in Combating Corruption and Bribery

Bribery and corruption represent a critical nexus where ethics, governance, and societal values intersect. These issues have long been a stain on both public and private sectors, creating distrust and distorting fair competition. International bodies and conventions typically define public sector corruption as the abuse of public office or a position of public trust for private gain. Explore a recent case study and how organizations can protect against corruption.

Russian Use of Crypto for Sanctions Evasion on the Rise

Experts agree there isn't enough liquidity in the virtual assets space to enable largescale sanctions evasion by Moscow, but sanctioned individuals and entities have used virtual currencies—most notably Tether—to access the global financial system and pay for restricted goods and technologies. Explore recent designations, how cryptocurrencies and other virtual assets are being leveraged to facilitate evasion as well as risk mitigation strategies for financial institutions in our latest article.

AI in Crypto Security: Navigating the Dual Edges of Innovation and Vulnerability

As cryptocurrencies gain mainstream acceptance, they also become a new frontier for financial crimes, including money laundering, fraud, and the financing of terrorism. Amidst this burgeoning digital economy, AI emerges as both a beacon of hope to help prevent crimes and a potential threat, giving illicit actors additional resources to move proceeds of crime. The dual nature of AI in combating or facilitating crypto-related financial crimes presents a complex puzzle: Is AI a harbinger of risk or the ultimate solution to mitigate it in this digital age of ambiguity?

Fake News vs. Real News – The Importance of Media in Due Diligence

We exist in an age when mass media outlets are criticized for bias and manipulation, and when foreign disinformation efforts further erode trust in traditional journalism. Confidence in media reports not just as a compliance tool, but also as reliable news sources is likely at near record lows as well. However, adverse media reports are a critical compliance tool that can serve as a springboard for more extensive due diligence research and can help identify potential indicators of sanctions evasion and other financial crimes.

Digital Assets in the Crosshairs

As the digital economy burgeons, cryptocurrencies, tokens, and NFTs have shifted from niche investments to central elements in global finance. Yet, this rapid growth brings complex challenges, especially in the realm of financial security and regulatory compliance. Explore how these assets are increasingly being used to fund activities that threaten global security.

Counterproliferation Finance Detection and Deterrence – What Can Financial Institutions Do?

The U.S. Treasury recently identified proliferation networks operating on behalf of Russia, North Korea, China, Iran, Syria, and Pakistan as threats to U.S. national security. These networks exploited the U.S. financial system to finance the proliferation of weapons of mass destruction (WMD), including financing to procure WMD components and raising revenues to support efforts by these state actors to advance their WMD activities.

2024 National Proliferation Financing Risk Assessment

The U.S. Department of the Treasury published the 2024 National Proliferation Financing Risk Assessment in February 2024 providing an in-depth analysis of the threats and vulnerabilities related to proliferation financing (PF) and highlighting key countries and non-state actors working to gain access to weapons of mass destruction (WMDs) and their components and to conventional restricted weapons and technologies.

Liberating Limits: OFAC Licenses

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) safeguards national security and helps advance U.S. foreign policy objectives by administering the U.S. sanctions regime. OFAC’s general and specific licenses serve as key mechanisms for authorizing and regulating certain transactions that would otherwise be prohibited under sanctions programs. The exceptions provided by licenses help businesses and individuals navigate international transactions without violating U.S. sanctions policies.

Golden Visas & Global Graft – How Criminal Actors Exploit Citizenship by Investment Programs

While special naturalization programs offered in certain jurisdictions to foreign investors intend to attract foreign direct investment and economic and infrastructure development, these programs can be abused by criminals who seek to launder and conceal proceeds of crime or commit new offences, including financial crimes.

Crypto Jargon Defined: Bridging the Gap Between Complexity and Comprehension

From mixers and tumblers to hot and cold wallets, the crypto space is laden with complex jargon. Explore our post in which we simplify the language of the digital economy. Ideal for enthusiasts at any level—from curious beginners to those seeking deeper insights—this guide illuminates the path to mastering the nuances of digital, virtual, and crypto assets.

Stuck and Seized – Consequences of Forced Labor

Global economies are more interconnected than ever, and human rights abuses can have a profound impact on supply chains and disrupt the flow of goods. Recent deliveries of certain luxury vehicles, such as Porsches, Audis, and Bentleys have been delayed because a small component that links those vehicles with computer networks was produced by a Chinese company linked to forced labor and surveillance of Uyghur populations in China.

Russia Sanctions Evasion Case Study: Viktor Labin

When conducting customer due diligence and enhanced due diligence, simple screening for names that may be on sanctions lists is no longer sufficient given the increasing complexity of Russia’s sanctions evasion efforts and the volatile regulatory environment because of Moscow’s aggression against Ukraine. Extra research is necessary to ensure compliance with sanctions laws and adherence with your company’s own risk policies. This research, however, can be complex, and structured analytic techniques and tools are necessary for effective due diligence.

Are Casinos Havens for Money Laundering?

A recent UN Office on Drugs and Crime (UNODC) report has found that casinos, junkets, and cryptocurrencies are exacerbating transnational organized criminal activity in East and Southeast Asia as part of the region’s underground banking and money laundering infrastructure. Although the use of casinos to launder money is not new, the proliferation of online gambling since the COVID 19 pandemic has aggravated the existing problem and has given rise to underregulated online gambling venues as more gamblers began playing from home.

Binging Griselda? Let’s Talk Drug Trafficking Sanctions

Netflix’s new series Griselda tells the story of Griselda Blanco. Known as the “Godmother of Cocaine,” Blanco trafficked cocaine from Colombia to Miami from the 1970s to the early 2000s. Despite her criminal activities, Blanco managed to evade law enforcement for many years. There were no sanctions against Blanco at the time, since the Kingpin Act, a U.S. law aimed at combating international drug trafficking and organized crime, was enacted in 1999 after Blanco’s sentencing.

Risky Russia – Government Agencies Warn Businesses of Possible Trouble

The US Departments of State, Treasury, Commerce, and Labor in late February issued a business advisory warning firms and financial institutions about the serious legal, financial, and reputational risks of doing business in Russia. According to the State Department’s assessment, Russia’s kleptocratic environment undermines fair competition and the rule of law, exposing businesses to the risk of extortion, appropriation of assets, and US law enforcement action.

Thanks to Russia, Cross-Border Sanctions Collaboration at All-Time High

Russia's unprovoked invasion and continued aggression in Ukraine has led to an unprecedented level of collaboration by sanctions stakeholders across jurisdictions, agencies, and sectors. IFI is publishing a series of blogs to highlight this increased collaboration. In this first blog, we take a look at cooperation across borders and most notably by the REPO Task Force and Price Cap Coalition.

Beyond The Hype: The True Role of Virtual Assets in Russia Sanctions Evasion

With the onset of stringent sanctions against Russia in 2022, US officials and financial analysts began to speculate about the potential for cryptocurrencies to serve as a means for evasion. But can virtual assets enables a nation's efforts to evade sanctions?

Ukraine’s War on Two Fronts – Fighting Corruption Amidst Russia’s Continued Attacks

As the second anniversary of Russia’s full-scale war of aggression in Ukraine approaches, winning on the battlefield remains the top mission objective for the Armed Forces of Ukraine, the Ukrainian people, and Ukraine’s international partners. While the full-scale invasion began two years ago, addressing systemic governmental and economic corruption has been an enduring battle for Ukraine since it gained its independence from the Soviet Union in 1991.

Pig Butchering on the Rise: When Romance Goes Wrong

What is pig butchering and how does it work? Read on to explore the global regulatory response to this rising scam, identify scam tactics and key mitigation strategies.

Exhausting Russian Resources by Sanctioning Western Software

Despite the Kremlin's attempts to reduce reliance on Western software for crucial systems, this transition is advancing slowly, presenting significant opportunities to hinder Russia's military effectiveness and economic activities. Read on for more information on the current role of Western technology and guidance for governments and companies formulating sanctions proposals.

Evading Export Controls – Russia’s Key to Success

Russia has used third-party intermediaries to evade sanctions and export controls for years and has disguised the involvement of SDNs or sanctioned entities in transactions to obscure the true identities of end users. This activity has increased since Russia’s invasion of Ukraine in 2022 due to Russia’s need for military equipment.

Bad News for Corruption in 2023, Along with Some Bright Spots

Transparency International released its annual Corruption Perceptions Index, ranking 180 countries and territories by their perceived levels of public-sector corruption. Explore the highlights within.

Human Trafficking

January is National Human Trafficking Prevention Month, and IRS-Criminal Investigations (CI) is partnering with other government agencies to highlight indicators and federal initiatives to combat this crime.

Bitcoin Breakthrough – Navigating the New Era of SEC-Approved Spot Bitcoin ETPs

The US Securities and Exchange Commission's (SEC) landmark approval of 11 Spot Bitcoin Exchange-Traded Products (ETPs) from several leading financial firms, including BlackRock, Fidelity, and Grayscale Investments, this month marks a significant shift in the regulatory landscape for virtual assets.

Real Estate in 2024 – Anticipating a Crackdown on Corruption & Fraud

Real estate in the United States has long been a popular channel for corrupt actors seeking to launder illicitly obtained funds. As part of the Biden administration’s 2021 Strategy on Countering Corruption, a long-awaited proposed rule from the Treasury Department that is slated to take effect in early 2024 will seek to address that glaring loophole in US anti-money laundering (AML) regulations.

How to Avoid Becoming an Unwitting Facilitator of Russian Sanctions Evasion

What steps can organizations take to avoid becoming unwitting suppliers of critical components and tools for the Russian military?

The Importance of a Sanctions Compliance Program – Top 5 Mitigating Measures Highlighted by OFAC in 2023

OFAC in 2023 reached settlements with 17 companies, collecting more than $1.5 billion in penalties. Mitigating factors can help reduce the severity of penalties imposed by OFAC for sanctions violations and often involve significant remedial measures and enhancements to a company’s sanctions compliance program.

A Pivotal Year for Virtual Assets – 2023 Highlights

2023 was a year of significant upheavals in the world of virtual assets, highlighting glaring vulnerabilities and the dire need for regulatory interventions. From major financial losses caused by security breaches to high-profile legal battles and settlements, 2023 was chock full of developments that almost certainly demonstrate the resilience and endurance of virtual currencies.

A Timeline of US, EU, and UK Sanctions on Russia in 2023

The United States, United Kingdom, and European Union, among others, have increased their focus on enforcement, updated sanctions lists and export controls to limit Russia’s access to sensitive technologies, and taken steps to punish illicit actors assisting Russia. Explore a list of the various sanctions imposed by the United states, EU, and UK in 2023.

Biden Signs Executive Order Targeting Foreign Banks Supporting Russia

US President Joe Biden on December 22, 2023, signed an executive order to authorize the US Treasury Department’s Office of Foreign Assets Control (OFAC) to designate foreign financial institutions that help Russia’s defense industry, as Moscow’s war against Ukraine approaches its two-year anniversary.

What Financial Institutions Can Learn from the Binance Settlement

Explore lessons learned from the recent Binance settlement including risk mitigation strategies for banks and other financial institutions.

Binance Settles with Regulators

Binance, the world’s largest cryptocurrency exchange, on November 21st pleaded guilty and agreed to pay more than $4.3 billion to resolve the US Justice Department’s investigation into its violations of the Bank..

Cyber-Enabled Fraud

Cyber-enabled fraud (CEF) is growing, especially with increasing digitalization across the globe.

Technological advances have enabled cyber criminals to develop and increase the scale,

scope, and speed of their illicit activities.

Terrorist Use of Crowdfunding

The nature of crowdfunding, the use of new technologies, and the possible anonymity afforded by crowdfunding platforms can make them attractive as relatively quick and simply means to obtain donations from across the world.

Partial Sanctions Relief for Venezuela

On October 18, 2023, the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) issued six general licenses authorizing categories of transactions that were previously prohibited under the U.S. sanctions program against Venezuela.

Best Practices for the Maritime Oil Industry to Detect Restricted Trade in Russian Oil

Price Cap Coalition partners have published an Advisory following reports that Russia has been evading the $60 per barrel price cap that was imposed by the Coalition last year. The Advisory provides some best practices and recommendations to the maritime oil industry to help stakeholders reduce their exposure to risks of Russian oil cap evasion by detecting restricted trade in Russian oil.

MiCAR Defined – The EU’s Blueprint for Crypto Regulation

The Markets in Crypto-Assets Regulation (MiCAR) went into effect on June 29, 2023, and will be fully applied by December 30, 2024.

Domestic Terrorism – Understanding the Threat and How Banks Can Counter It

Domestic terrorism is not a new threat in America, but in recent years we have seen a significant and horrific increase in violent attacks and activities carried out by individuals and groups motivated by a range of radical ideologies. In response to these troubling developments, our government has stepped up law enforcement, intelligence attention, and resources to combat these threats.