Lessons from the Frontlines of AI in Compliance

Insights and Best Practices for Responsible Gen AI Adoption in Financial Compliance

📅 January 6, 2025

📅 January 6, 2025

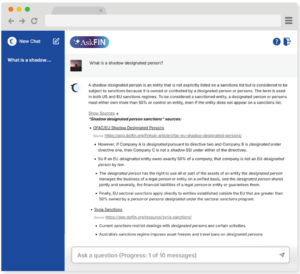

Generative AI (gen AI) is reshaping financial compliance, unlocking new capabilities for productivity, decision-making, and insight generation. However, implementing gen AI effectively requires navigating significant challenges and opportunities. At the Institute for Financial Integrity (IFI), we’ve drawn on real-world experience in developing AskFIN, our proprietary gen AI-powered financial crime assistant, to identify strategies for leveraging this technology responsibly.

By examining approaches for integrating gen AI while addressing critical considerations like data quality, user education, and governance, this article provides actionable steps for financial compliance leaders aiming to stay ahead in an evolving regulatory and technological landscape.

Organizations best positioned to succeed with gen AI are those with a robust and well-structured data asset or knowledge store. High-quality data is foundational for gen AI to function effectively, as poor data quality can undermine the entire process, leading to inaccurate results and eroded trust—highlighting the adage, “garbage in, garbage out.” However, data perfection is rarely achievable. Rather than waiting for flawless data, it’s often better to start with what you have, breaking ground and building while continually improving your data story along the way.

While model (LLM) selection is important—not all models are created equal and there are models that excel for specific purposes—it is becoming less important with the rate of improvement, the convergence of model performance on specific tasks, and the increasing ease of running concurrent model testing or even swapping out models on the fly. Whatever you start with, it will likely be overtaken quickly by something else. Don’t overthink where you start but instead set a baseline, establish your review practices, and find ways to continually compare what you are using with what is available as you evolve.

Users of gen AI solutions bring varying levels of familiarity with the technology. Providing education and tools that help users engage effectively with gen AI is essential. Features like prompt guidance and tailored training workshops empower users to make the most of gen AI capabilities. This approach bridges knowledge gaps and builds confidence across diverse user groups.

Educating employees and customers on fraud risks, particularly those posed by AI, is essential. Learn more about strategies for AI fraud prevention in our article, “Elevating Defenses: Strategies for AI Fraud Prevention”. It outlines key steps to empower teams and improve defenses against emerging threats like deepfakes and biometric spoofing.

For insights into the evolving role of compliance professionals in an AI-driven landscape and the importance of upskilling, see “AI vs. Human Judgment”. It discusses how professionals can adapt to the shift toward strategic and governance roles.

In compliance, privacy and security are foundational. Implementing localized data processing environments, as was done with AskFIN, ensures sensitive information is safeguarded and does not feed external models. Permission-based access controls add another layer of security, aligning with the unique demands of the compliance space.

Transparency around sourcing and function is not just appreciated—it’s required. A “black box” solution erodes trust, increases user confusion and questions, undermines adoption, and adds strain on client support teams. Providing context about how answers are derived and linking them to credible sources fosters accountability and confidence. Even after initial implementation, organizations must continuously iterate to maintain transparency, trust and confidence.

Robust guidelines and guardrails are essential to manage the dynamic capabilities of gen AI. These measures help ensure responsible AI application and mitigate potential harm. For example, AskFIN has implemented guardrails to prevent questions outside the financial integrity domain while maintaining flexibility for users to introduce new terms within the model’s learning scope.

Continuous validation and iterative improvements are vital in the dynamic gen AI landscape. For example, with AskFIN, ongoing testing of its knowledge repository, architecture, and underlying models ensures its capabilities remain current and effective. This commitment to quality assurance builds resilience in rapidly changing environments.

To deliver trusted gen AI solutions like AskFIN, the following approaches were adopted:

We embraced a collaborative, multidisciplinary approach to implementing gen AI, bringing together the expertise of in-house subject matter experts (SMEs), technical and product teams, and valuable insights from our clients. This approach ensured a well-rounded perspective that addressed every aspect of the implementation process. Actively seeking out diverse viewpoints allowed us to refine functionality, tackle emerging challenges, and drive innovation to create a solution that truly resonates with users.

We engaged a second development team to “red team” our process, using a creative approach to identify opportunities for rapid improvement and uncover vulnerabilities to address. Much like a penetration test designed to challenge boundaries and think outside the box, this skilled external team applied their expertise to critically evaluate and expand our mental models, ensuring a more robust and innovative outcome.

Collaborating with external teams for testing and validation is a valuable strategy for identifying vulnerabilities and enhancing systems. To understand more about collaborative approaches in AI, see “Exploring the Balance of Innovation & Responsibility”, which discusses how organizations can engage regulators and industry peers for effective AI governance.

The journey to integrate gen AI into financial compliance is filled with both challenges and opportunities. From ensuring high-quality data to fostering user education and embracing iterative development, leaders can take actionable steps to harness AI’s potential responsibly. By learning from the experiences of others and remaining adaptive to this rapidly changing landscape, the financial compliance industry can lead the way in leveraging AI for transformative results.

AskFIN is a revolutionary, AI-powered tool seamlessly integrated with DOLFIN® — the world’s largest and most trusted library of curated resources on financial integrity topics.

Built to support financial integrity professionals, AskFIN offers just-in-time knowledge and boosts productivity by providing fast, accurate responses on the latest regulatory developments and compliance requirements. Combined with the advanced technology from DOLFIN®, the largest and most trusted library of financial integrity resources, AskFIN delivers a unified solution to ensure professionals are informed and equipped to help protect the global financial system from use by illicit actors.

Shell Companies as an Enabler of Export Control Violations

Shell Companies as an Enabler of Export Control ViolationsThis site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy