A Tipping Point

Generative AI and Financial Compliance

📅 December 5, 2024

📅 December 5, 2024

The financial integrity landscape continues to evolve, as do the techniques illicit actors employ to avoid controls, so too must our strategies and technologies as financial integrity professionals. Generative artificial intelligence (gen-AI) promises to revolutionize how people learn, expand their knowledge, unlock knowledge in the moment, and boost their productivity, unlocking new efficiencies and capabilities in the fight against financial crime.

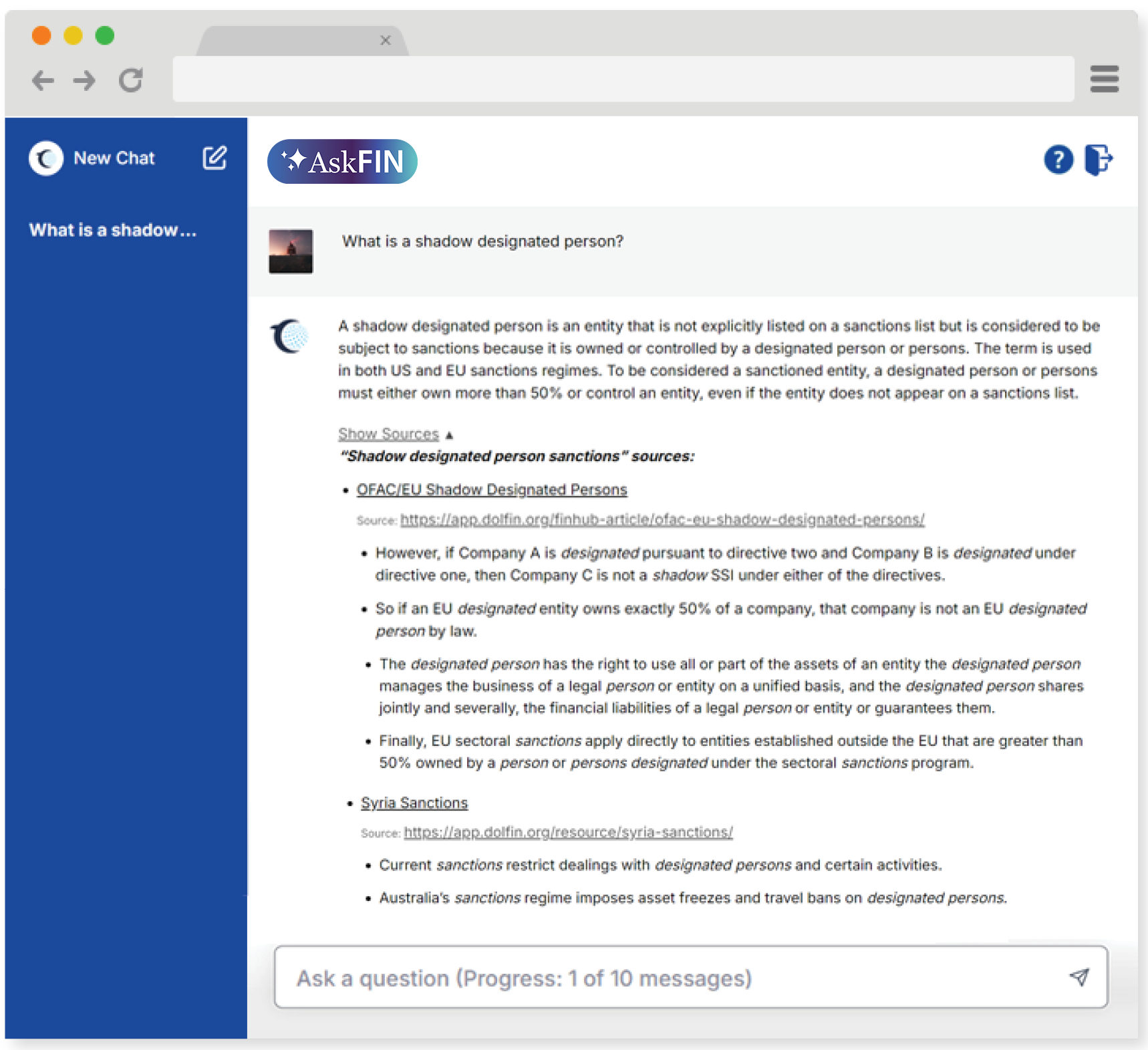

As an early adopter of gen-AI in financial compliance, the Institute for Financial Integrity (IFI) launched AskFIN, a gen-AI-powered financial crime assistant, in BETA in Q2 2024. AskFIN, now available to all DOLFIN users through an expanded BETA, exemplifies the transformative potential of AI when paired with authoritative resources and a focus on privacy and security.

It’s important to contextualize and baseline gen-AI within AI. AI serves as an umbrella term that encompasses a range of technologies, including—but not limited to—machine learning (ML), natural language processing (NLP), deep learning, gen-AI, and others. While AI is often casually used interchangeably with these terms, AI is not synonymous with gen-AI. This is a key distinction because the language and nuance we use when discussing these topics is important.

While AI has been around since the 1960s, with the creation of the first chatbot (Eliza), and most institutions have been using machine learning (ML) for decades, the recent buzz and surge in interest can be attributed to advancements in gen-AI capabilities—the new kid on the block.

Gen-AI made its debut in 2014 with the introduction of Generative Adversarial Networks (GANs). However, it was not until the release of ChatGPT-1 in 2018 that gen-AI began to gain broader traction and application. The tipping point came in 2022 with the launch of ChatGPT-3.5, which propelled gen-AI into the mainstream.

The adoption of ChatGPT has been the fastest of any technology in history; it achieved an unprecedented milestone of reaching 1 billion monthly users within just three months of its launch. This explosive growth can be attributed to significant improvements in NLP and computational capabilities, particularly in hardware like Graphics Processing Units (GPUs).

Today, gen-AI is everywhere, including on our cellphones. We have passed the tipping point—the irreversible moment—and gen-AI implementations and applications, and their impact on our lives, will only increase.

Most institutions are experimenting with gen-AI, methodically exploring benefits and risks. One of the biggest challenges with deploying gen-AI is that the outputs are “non-deterministic.” Put another way, when used in products, gen-AI regularly provides different outputs for the same input on different executions.

To be generative and connect the dots, gen-AI must make assumptions and decisions with imperfect and incomplete information—gen-AI is dynamic by design. This introduces significant complexity to building products and capabilities with gen-AI, particularly in the compliance space. While gen-AI can deliver incredible outputs that significantly improve productivity, most outputs require human review.

The opportunity we face is how to best pair ourselves with these new capabilities. I am a strong advocate of Harvard Business School Professor Karim R. Lakhani’s thinking that “AI [won’t] replace humans, but humans with AI [will] replace humans without AI” and similarly “human-computer symbiosis.” Deploying gen-AI is about understanding how to get the best out of these capabilities. The ultimate configuration will likely vary within each institution and on each task/objective.

For a deeper dive into the history of AI and its application in financial compliance, including the evolution from ELIZA to ChatGPT and beyond, refer to our article, “Exploring the Balance of Innovation & Responsibility”. This article summarizes a recent webinar featuring industry experts and discusses the foundational principles of AI in compliance.

While there is an ever-growing number of gen-AI powered chatbots out there, none compete directly with AskFIN for two reasons.

The rise of generative AI represents a pivotal moment in financial compliance, offering transformative opportunities to improve productivity, learning, and decision-making. As we explore this new frontier, understanding the nuances of AI and how to harness its potential responsibly will be critical for industry leaders. In our next post, we’ll dive deeper into the challenges of balancing innovation with security and trust in AI-powered compliance solutions.

AskFIN is a revolutionary, AI-powered tool seamlessly integrated with DOLFIN® — the world’s largest and most trusted library of curated resources on financial integrity topics.

Built to support financial integrity professionals, AskFIN offers just-in-time knowledge and boosts productivity by providing fast, accurate responses on the latest regulatory developments and compliance requirements. Combined with the advanced technology from DOLFIN®, the largest and most trusted library of financial integrity resources, AskFIN delivers a unified solution to ensure professionals are informed and equipped to help protect the global financial system from use by illicit actors.

Webinar Recap – The Dos, Don’ts & Expert Insights on Beneficial...

Webinar Recap – The Dos, Don’ts & Expert Insights on Beneficial...This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy