Cartels, Cash, and Capital Flows

Five steps financial institutions can take to deliver an effective response to cartel risk

📅 April 22, 2025

📅 April 22, 2025

Several drug cartels were recently designated as “foreign terrorist organizations” (FTOs) by the United States, representing an amplification in focus on the threat they present to national and collective security, and on the harm fentanyl and narcotics trafficking cause American citizens.

What are the implications for financial institutions of cartels being designated as terrorist organizations?

While designation of cartels is not new and financial institutions should already have effective controls in place, the FTO designations raise the stakes if non-compliance occurs and signal a likely focus for future enforcement action. Now would be a good time for financial institutions to verify the effectiveness of their counter-cartel programs.

Overview of Cartels & Chinese Money Laundering Networks

Cartels continue to adapt their methodologies to acquire, launder, move, and spend funds. Chinese Money Laundering Organizations (CMLOs) are now a key element of cartel operations, as described in this article. One common typology is outlined below.

Cycle 1: Cartel Laundering

Cycle 2: Chinese Capital Transfer

Importantly for financial institutions, the methodology above does not use cross-border payments. USD cash is deposited into U.S. banks, transferred within the U.S. financial system, and subsequently spent in the United States. Chinese RMB are transferred within China. Mexican pesos are moved within Mexico (or an equivalent other countries). The traditional assessment of cross-border payments as being consistent with illicit financial flows, such as “layering” laundered proceeds, is weakened.

The first step for a financial institution is to undertake or update its institutional risk assessment. This will enable it to understand the threat presented by cartels and their money laundering networks, and then to assess and then manage the risks. The risks are different depending on the type of financial institution: banks, crypto firms, and money services businesses (MSBs) and payment processors, will have visibility of different risk indicators and typologies and are exposed to different aspects of cartel operations.

Some examples of these differences and their implications for the institutional risk assessment include:

In addition, as with all illicit finance risk assessments, considerations include how the financial institution is exposed to cartel and related money laundering risks through:

The risk assessment must then inform the processes and systems that comprise the internal controls program of the financial institution.

Since cartels were already designated, even prior to the categorization as FTOs, an institution’s existing controls should already be operating effectively to identify and respond to risk indicators. These controls include due diligence on clients, screening against lists of designated entities and individuals, transaction monitoring to identify risk indicators, and investigations of unusual activity. Investigations may be proactively generated by internal alerts or intelligence-led based on information provided by law enforcement and government Financial Intelligence Units.

Many of the methods used by cartels are shared with other types of illicit activity and should already be built into preventative and detective controls. For example, cartels use front and shell companies to launder the proceeds as well as obscure the source and destination of shipments of precursor chemicals. Front and shell companies are also used in sanctions evasion, export control evasion, and many types of money laundering.

Processes and systems must be regularly updated to ensure they remain up to date on evolving threats and risks. This can be achieved by regularly testing automated systems to ensure they are operating effectively and providing training to staff to ensure their knowledge and skills are current.

For example, traditionally cross-border payments were considered a key indicator of money laundering as illicit networks attempted to move and launder proceeds. As cartels and CMLOs increasingly use “mirror transfers”, cross-border payments are no longer required, and financial institutions can no longer rely on cross-border payments to identify cartel activity. This adaptation in criminal methodologies should feed into automated controls and investigative methodologies.

Training for staff should be customized to how cartel and money laundering activity could present to their role and should link back to risk indicators and typologies. Training should use up-to-date, relevant examples to enhance engagement and knowledge retention, and should be delivered through regular refreshers as well as annual baseline training.

Some examples of customized training relevant to cartel risks are:

Advisories and alerts are regularly issued by government Financial Intelligence Units and other sources, such as FinCEN’s recent financial trend analysis on fentanyl-related illicit finance. Additional sources include analysis and summaries by educational institutions, policy advisors and thinktanks, among others.

Financial institutions should establish processes to identify updates, review them, and apply them within their organization. For example, when an alert with red flags is published, the institution should evaluate which ones are relevant to its business, and how they will be applied within its controls. Some red flags may be suitable to be implemented as automated controls, whereas others may not be sufficiently distinctive and are instead of value as context during an investigation. Institutions should follow a structured approach to assessing and applying red flags, like this one on export controls which can be applied equally to other illicit finance domains.

Institutions would be well advised to consider using advanced data analytics to look beyond red flags to identify new and as-yet-unidentified risk indicators. Data analytics tools can compare groups of clients by entity type, sector, and geography, to identify outliers which can then be investigated to identify whether the unusual patterns are the result of illicit activity.

In addition to regulatory filing requirements such as Suspicious Activity Reports (SARs), financial institutions and public sector organizations should engage in additional initiatives to share intelligence on cartel risks, typologies, and indicators.

Depending on the regulatory provisions and restrictions on intelligence sharing, this may be at the “strategic” or “typology” level, which involves sharing patterns and trends, or at the “tactical” or “operational” level, in which information about specific clients, transactions, and investigations is shared.

The public sector – including law enforcement and government Financial Intelligence Units – has a critical responsibility. While financial institutions can identify unusual activity, leads from law enforcement are critical to provide context for whether this is actually cartel activity. Law enforcement can also provide additional detail that can be used to adapt and fine-tune automated controls, resulting in greater accuracy and more efficient use of resources for both financial institutions and public sector partners.

This article outlines some of the key actions financial institutions should take as part of their counter-cartel programs, which should be expanded and adapted as required depending on the institution’s risk assessment

Cartels and their illicit finances represent significant threats to societies globally and require joint and effective action to respond. This goes beyond compliance: it is about national and collective security, and protecting lives.

Sign up for the Dedicated Online Financial Integrity Network (DOLFIN). A powerful resource for industry professionals, membership grants unlimited access to our extensive library spanning the core financial integrity topics.

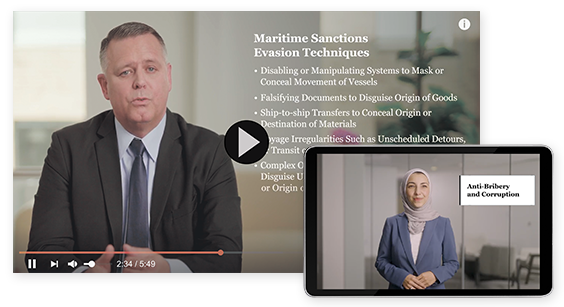

An on-demand video library designed for today’s risk environment, this expert-led training program make complex topics clear, practical, and engaging—ideal for onboarding, upskilling, or refreshing core compliance knowledge across your teams.

When Less is More

When Less is MoreThis site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy