Optimizing Effectiveness

Best Practices for Smarter, Strategic Training Design

📅 June 10, 2025

📅 June 10, 2025

If you read Why Compliance Training Still Fails: The Cost of a Check-the-Box Culture, you know just how costly “check-the-box” compliance training can be—from regulatory fines to cultural disengagement. The good news? There’s a better way.

It’s not about piling on more training hours or rolling out another annual module. It’s about being strategic—designing learning experiences that actually help people recognize risks, make better decisions, and build a culture where compliance is everyone’s business.

The Case for Smarter, Strategic Training Design

So, what does smarter compliance training look like in practice? Here’s what makes the difference:

1. Risk-Based Customization

No two teams face exactly the same risks. The most impactful training is tailored to the real threats facing each business unit, product line, or geographic region. Instead of enterprise-wide programs covering generic concepts, organizations need learning paths that speak directly to the risks employees encounter in their roles—whether that’s handling high-risk clients, managing cross-border payments, or onboarding customers in emerging markets.

2. Scenario-Driven and Role-Specific Learning

People learn best when they see themselves in the material. Training should reflect the realities of day-to-day work. When staff recognize real-world situations in their learning—like spotting suspicious activity in a wire transfer or navigating a difficult customer onboarding—they’re more likely to engage and remember what matters. Interactive scenarios and practical case studies help bridge the gap between theory and action.

3. Learning That Keeps Pace with Change

The financial crime space evolves fast. Training should too. The best programs are updated regularly to reflect new criminal tactics, regulations, enforcement trends, and lessons learned from recent cases—so your team is always prepared for what’s next

4. Quality Video Content and Tailored Webinars

Engaging modules that use video-based content (rather than endless slides or bulky text) make training memorable and actionable. High-quality, expert-led videos and targeted webinars bring complex topics to life and let teams dig into the latest trends or challenges—whether it’s a new regulation, fraud typology, or practical response to a red flag. This approach reduces fatigue and builds engagement.

5. Microlearning and Ongoing Reinforcement

People learn best when information is delivered in manageable pieces and revisited regularly. Microlearning—short, focused lessons—keeps training accessible and relevant. Regular refreshers and knowledge checks ensure concepts stick, and new risks or regulations are quickly addressed as they arise. Updates tied to emerging risks keep compliance top-of-mind all year, not just during annual training season.

6. Clear Outcomes, Not Just Completion

Progress should be measured by real behavior change—not just who finished a course. The most effective programs track meaningful outcomes: improved red flag reporting, reduced policy violations, or better audit results. Training should be a living part of performance, not a forgotten box on an annual checklist.

7. Use of Technology and Data

Modern learning platforms enable adaptive learning, delivering content based on user progress and knowledge gaps. Feedback loops and analytics help compliance teams spot where employees are excelling or struggling—so training can be continuously improved and risks addressed quickly.

8. Shared Responsibility and Buy-In

Finally, training can’t just be “a compliance thing.” The most successful programs involve stakeholders from compliance, legal, HR, business units, and leadership—making compliance learning a shared goal across the organization. When the tone is set at the top, and business lines see training as a tool (not a hurdle), engagement and accountability follow.

Finally, financial institutions don’t have to do it all themselves. While your core competency is delivering financial services, effective learning design is a specialized skill. Many leading organizations choose to partner with experts who know how to build training that truly sticks—so your team can focus on what they do best, and still meet (or exceed) compliance expectations.

Moving beyond “check-the-box” training isn’t just a compliance win— it’s a strategic investment in risk reduction, trust, and long-term resilience. By investing in training that is practical, relevant, and dynamic, financial institutions can reduce risk, build trust, and foster a resilient culture equipped for today’s—and tomorrow’s—challenges.

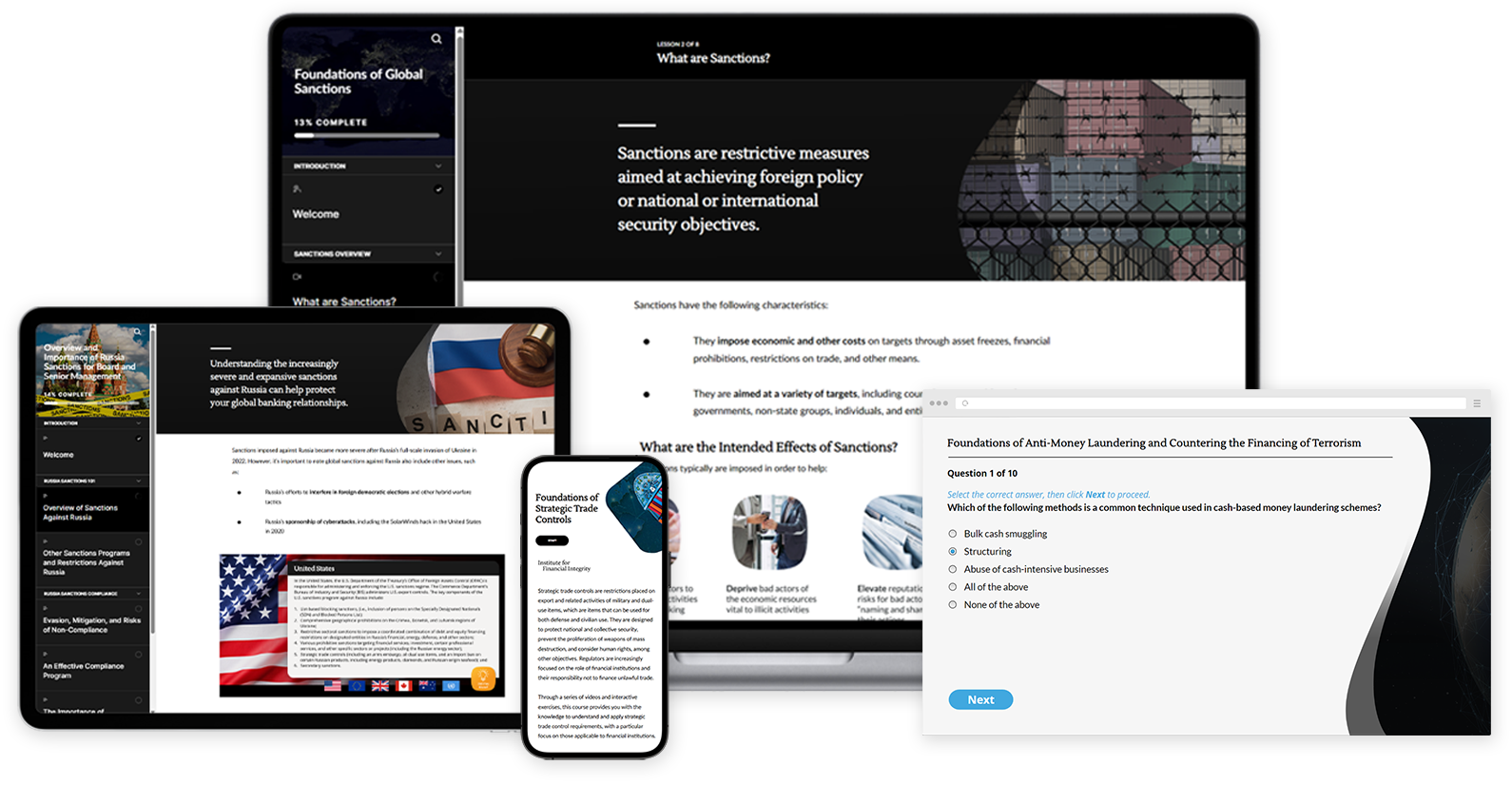

Explore our suite of compliance e-learning courses covering an array of financial crime compliance topics. All courses are designed to maximize retention of relevant knowledge and are available for customization.

First Iraqi Bank Selects IFI Training Program to Strengthen Financial Integrity...

First Iraqi Bank Selects IFI Training Program to Strengthen Financial Integrity...This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy