Training for the Wrong Risk

Are Your Compliance Programs Chasing Yesterday’s Threats?

📅 August 13, 2025

📅 August 13, 2025

What if your institution’s greatest vulnerability isn’t untrained staff—but well-trained staff on last year’s risks?

You’ve rolled out the training. Staff have completed the modules. The audit box is checked. But something still feels off. Frontline teams aren’t flagging what they should. Emerging threats are slipping through. And when regulators come knocking, what’s on paper doesn’t always reflect what’s happening in practice.

It’s a quiet but costly disconnect.

Financial crime is evolving fast—AI-generated scams, sanctions evasion through crypto, new pressure to monitor ESG-linked risk. But too often, the training designed to prevent these risks is still looking backward—relying on outdated case studies, static risk typologies, and content that hasn’t caught up with today’s reality.

It’s not that training isn’t happening. It’s that it’s misaligned. And that gap—between what your team is learning and what they actually need to know—can become a strategic vulnerability. Especially when regulators now expect institutions to keep pace, not just keep record.

The threats financial institutions face today look nothing like they did a decade ago—and in many cases, not even five years ago. Yet many compliance programs still train as if they do.

Across the industry, we’re seeing a sharp evolution in typologies, tools, and tactics:

These aren’t theoretical risks—they’re happening in real time. But most training programs still focus on outdated typologies and old case studies.

It’s not just a content problem—it’s a strategic one. Teams are being asked to manage 2025-era risks with 2015-era training. That gap creates confusion, weakens internal controls, and leaves institutions exposed.

The risk landscape has evolved. It’s time the training did too.

It’s easy to assume that if training is being delivered, the risk is being managed. But in today’s environment, outdated training can do more harm than good—creating a false sense of preparedness while critical risks go unaddressed.

Training that hasn’t kept pace with evolving threats often leaves employees focused on the wrong red flags.

The danger isn’t just in what teams don’t know—it’s in what they think they know.

This disconnect can show up in subtle ways: false positives that go unchallenged, red flags that get overlooked, or staff hesitation when facing unfamiliar scenarios. And when an investigation, audit, or enforcement action occurs, outdated training quickly becomes a red flag in itself—seen by regulators as a sign of weak oversight or poor program governance.

At best, it creates inefficiency. At worst, it exposes institutions to material compliance failures and reputational damage. Not because there was no training—but because the training missed the mark.

If the risk environment is evolving so quickly, why aren’t training programs keeping up?

The answer is rarely a lack of effort. Most institutions invest heavily in compliance education. But several structural issues create a persistent lag between emerging risks and the training that’s meant to address them:

Training is often reactive, not strategic. Many programs are shaped by past audit findings or prior regulatory feedback, rather than by forward-looking risk assessments. Content updates often come after an issue surfaces—not before.

Ownership is fragmented. Compliance owns the risk. Learning & development owns the content. Risk teams own the assessments. But rarely are all three in the same room when training decisions are made. The result is content that’s compliant, but not always relevant.

Over-reliance on off-the-shelf solutions. Vendor libraries offer convenience—but unless they’re updated frequently and tailored to your institution’s risk profile, they can reinforce outdated knowledge and miss nuanced threats.

Risk signals don’t always translate to learning design. Institutions might detect a rise in fraud attempts tied to fintech integrations or notice increased exposure to high-risk jurisdictions—but that intelligence often doesn’t flow into training frameworks in time to make a difference.

Update cycles are slow. Even when risks are identified, many institutions lack a mechanism to rapidly refresh their training materials. By the time new content is approved and deployed, the threat has evolved again.

In a fast-moving industry, these gaps become liabilities. Training that isn’t informed by current threats—and refreshed frequently—can’t prepare teams for what they’ll actually encounter. And regulators are starting to notice.

Learn more in our next article, From Outdated to Aligned, in which we explore what modern, risk-aligned training looks like—and how forward-thinking institutions are shifting their approach to stay ahead.

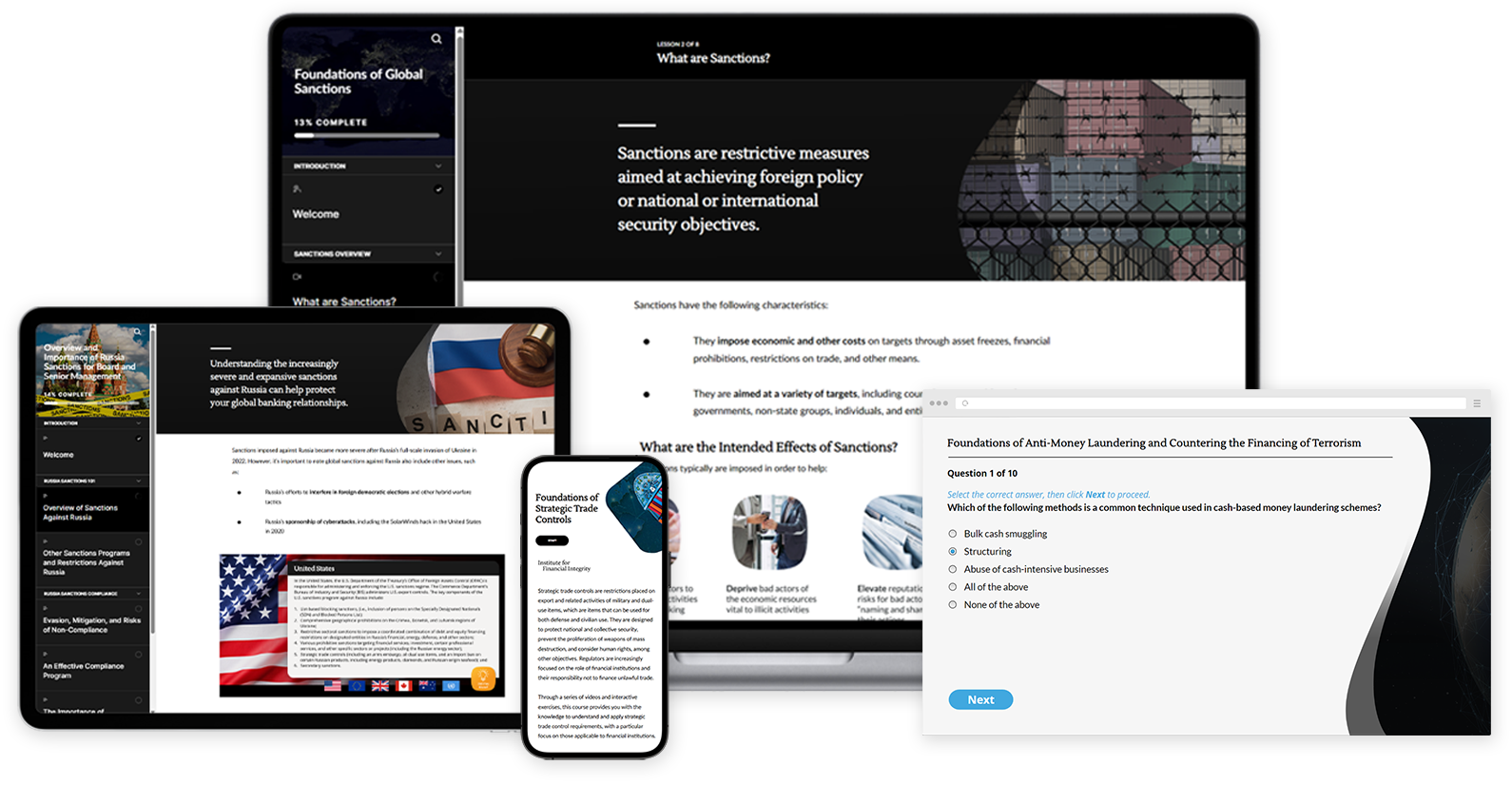

Whether it’s refreshing outdated courses, designing programs around high-risk areas or integrating scenario-based learning across teams—we can help ensure your compliance program is preparing people for what’s next, not just what’s familiar.

Explore our custom needs-based products and solutions.

From Outdated to Aligned

From Outdated to AlignedThis site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy