The Rising Standard

Why Compliance Oversight Belongs in the Boardroom

📅 September 24, 2025

📅 September 24, 2025

Compliance has outgrown the back office. What used to be seen as a technical box-checking exercise is now firmly in the boardroom spotlight. Regulators, investors, and even the public are all asking the same question: what did the board and senior management know, and what did they do about it?

For directors and senior leaders, the expectation has shifted. It’s no longer enough to rely on a compliance team’s updates or assume that policies on paper will hold up under scrutiny. Boards are being asked to lean in—to ask tougher questions, to understand the risks, and to show that they are actively steering the organization’s response.

The message is clear: the era of “we didn’t know” is over. Accountability lives at the top, and leadership will be measured not by what they delegate, but by how they engage.

The risks facing today’s financial institutions are no longer neat or predictable. Money laundering schemes now move across borders in seconds. Sanctions violations can happen with the click of a button. Fraudsters are using new technologies to outpace traditional controls. And a single data breach can undo years of trust with customers. For boards, this isn’t just background noise—it’s the environment you’re operating in every day.

Regulators have started sending a consistent message: leadership can’t sit on the sidelines. In the U.S., the Department of Justice and FinCEN have shown they are willing to hold individuals, not just institutions, accountable. Take the case of Thomas Haider, former Chief Compliance Officer at MoneyGram—he was personally fined $1 million and barred from the industry because fraudsters were able to exploit weaknesses in the company’s AML program. The takeaway was unmistakable: saying “we didn’t know” is not a defense.

The U.K. has taken a similar stance through its Senior Managers and Certification Regime (SM&CR). Under this framework, senior leaders must be able to show clear ownership of the areas they oversee. When Barclays’ then-CEO Jes Staley was investigated for mishandling a whistleblower case, it sent a clear signal: even the most senior executives will be held to account not only for technical compliance breaches, but also for how they set the tone at the top.

The same accountability trend has swept through the digital assets sector. The collapse of FTX and the conviction of its founder Sam Bankman-Fried wasn’t framed as a systems failure, it was pinned on decisions made by leadership. Also, when Binance’s CEO, Changpeng “CZ” Zhao, pleaded guilty to U.S. anti-money laundering violations in 2023, he stepped down, paid a $50 million personal fine, and accepted a prison sentence, while Binance itself faced $4.3 billion in penalties. Both cases sent a loud message: regulators are willing to go after the individuals making the calls, not just the companies they lead.

Even in traditional banking, consequences are hitting home. At TD Bank, CEO Bharat Masrani announced his retirement in April 2025, taking responsibility for the compliance failures under his watch. His pay was cut by 89%—from $13.2 million to $1.5 million— and the bank also cut variable compensation for 41 other executives, including former leaders and those with responsibilities in front-line operations, control functions, and internal audit, showing that boards and shareholders themselves are starting to enforce accountability at the highest level.

This call for accountability echoes at the global level. The Financial Action Task Force (FATF), which sets international AML/CFT standards, emphasizes that senior management must play an active role in ensuring that financial institutions maintain effective compliance programs.

And this isn’t just a U.S. or U.K. trend. Australia’s Banking Executive Accountability Regime (BEAR) and Ireland’s Senior Executive Accountability Regime (SEAR) show how accountability from the top is becoming a global norm. Around the world, regulators are aligned on one thing: compliance oversight cannot be delegated away.

Enforcement cases show that leaders who ignore warning signs, or who fail to escalate problems, can face penalties just as serious as if they had been directly involved.

What’s new here is the standard being applied: awareness is no longer enough. Regulators expect evidence of active oversight: board minutes reflecting tough questions, documented follow-ups on red flags, and proof that senior leaders were engaged when risks came to light.

For directors and executives, the message is clear. If something goes wrong, regulators will ask not just what the compliance team did, but what the board and senior leadership knew, when they knew it, and what they did about it.

But regulators aren’t the only audience boards need to think about. Investors want to know their capital is safe in well-governed institutions. Customers and the public want confidence that banks and financial institutions are acting with integrity. After so many high-profile scandals, trust has become a fragile currency.

The reality is simple: oversight isn’t just about avoiding penalties. It’s about protecting your institution’s reputation, resilience, and long-term stability. Boards that lean in, who ask the right questions and engage directly aren’t just keeping regulators satisfied. They’re building stronger, more trusted organizations.

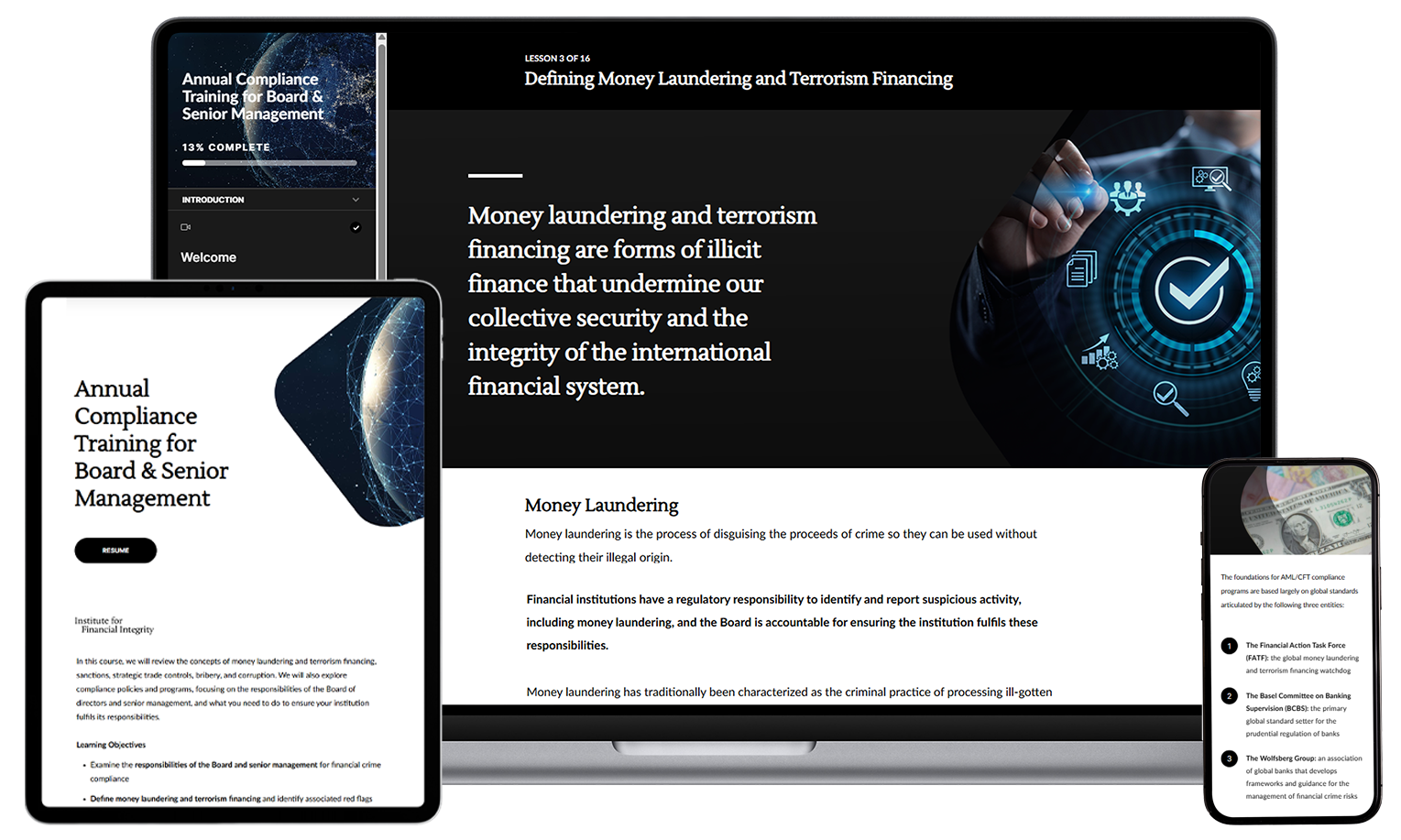

Effective oversight starts with informed leadership. That’s why IFI developed the Annual Compliance Training for Board & Senior Management—a course designed to help senior executives understand evolving risks, engage with the right questions, and demonstrate accountability in the boardroom. The training equips senior leaders to meet rising regulatory expectations and strengthen organizational resilience.

September 2025 Sanctions and Export Controls Update

September 2025 Sanctions and Export Controls UpdateThis site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy