Debt & Duty

How Chinese Money Laundering Networks target students to launder cartel proceeds – and the actions financial institutions can take

📅 December 4, 2025

📅 December 4, 2025

Cartels generate billions of dollars in the United States from drug trafficking, human trafficking and human smuggling, and other criminal activity. As Chinese Money Laundering Networks (CMLNs) represent an increasing proportion of cartel laundering, CMLNs target students to function as money mules. CMLNs use cultural obligation, debt bondage from rigged games at illegal casinos, and financial rewards to induce students to participate.

“Chinese students may be vulnerable to recruitment and exploitation as money mules by U.S.-based CMLNs, which need access to, and control of, many bank accounts to facilitate frequent cash deposits to place illicit proceeds into the U.S. financial system…” – FinCEN Financial Trend Analysis August 2025

A 2025 advisory from FinCEN highlights the scale of CMLN operations targeting students. From 2020-2024, more than 20,000 suspicious activity reports referencing individuals purporting to be Chinese students were filed by U.S. financial institutions. These reports represented approximately $13.8 billion in suspicious activity and were filed from multiple financial sectors including banks, MSBs, and casinos.

The laundering networks operated by CMLNs are extensive. In the United Kingdom, the National Crime Agency identified a network controlling 600 accounts at a single bank – and more accounts at multiple other financial institutions controlled by the same CMLN.

The methods used by CMLNs to recruit and control students have similarities across jurisdictions.

In the United States, FinCEN assessed that the reasons Chinese students could become involved included financial returns and obligations towards the Chinese community.

“CMLNs appear to have increasingly recruited Chinese students studying at U.S. universities, and some of these students may have continued to participate in CMLN operations after graduating… In some cases, individuals recruited by CMLNs may not understand that their actions are illegal, but rather were lured into participating in the schemes under the incentive of having a source of income and assisting other Chinese citizens or nationals in accessing U.S. dollars (USD).” – FinCEN Advisory

Similar patterns are seen in other countries. In the United Kingdom, Chinese students are recruited as money mules by being told they are providing transmission services for other students or unbanked Chinese citizens in the UK, accordingly to the UK National Crime Agency.

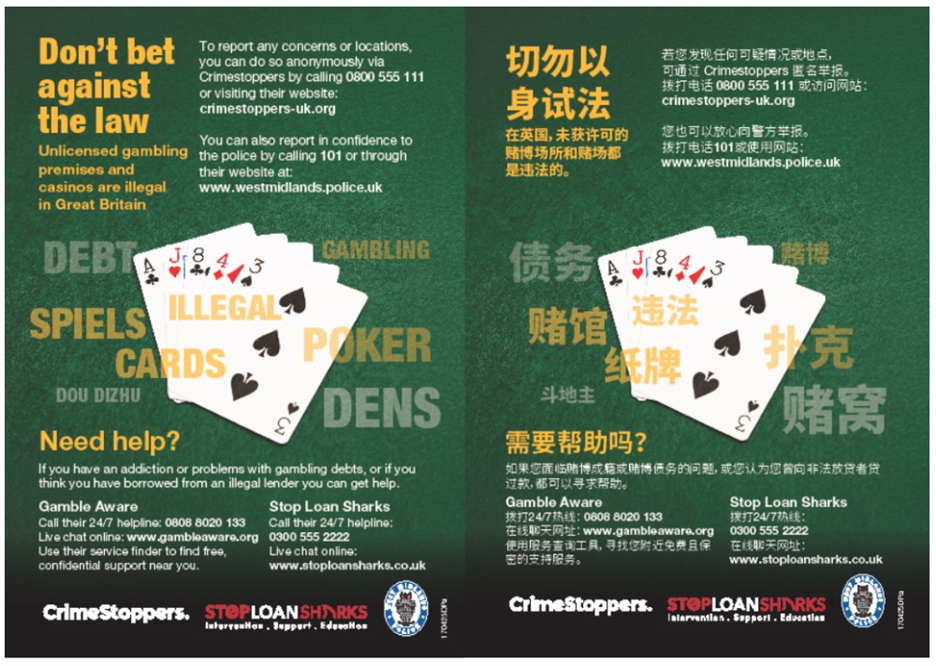

Chinese students may be coerced into being money mules, for example through “debt bondage” from gambling losses at illegal casinos (as described in the real-life example below). However, in many situations students are simply asked to undertake illicit activity, against a backdrop of cultural expectations and obligations.

A 2023 survey* of Chinese students in the United Kingdom undertaken by the UK Home Office Modern Slavery and Organised Crime Team identified that where students were targeted by Chinese criminal networks, many felt obligated to comply if they were simply asked. The key findings include:

* The preliminary findings from the study are used here with permission of the author, David Wilson.

As well as being recruited as mules to launder funds through financial institutions, CMLNs recruit students to act as buyers in daigou schemes as well as to launder money through casinos and gaming, real estate, healthcare, and other industries, and combinations of these.

An investigation by the West Midlands Police in the United Kingdom identified that overseas students were being targeted by criminal networks in illegal casinos using “rigged” games. For example, in one investigation the cards at the poker table were marked, then the play was monitored by a covert infrared camera. The information was relayed to another player, who used it to cheat the other players out of cash. The West Midlands Police identified that the criminal networks gained influence over students through their gambling debts, using this to coerce them into criminality.

While it may be difficult for financial institutions to identify the predicate offenses (such as narcotics trafficking or human trafficking), they are well-positioned to identify laundering of the proceeds.

Red flags that may indicate money mule activity, particularly by students, include:

🚩There are irregularities in documents which may indicate fraud, for example a Chinese passport and visa contain the same photograph despite purportedly being issued years apart.

🚩The person shown in the identity document has a similar appearance to the applicant, but is not the same person.

🚩Multiple accounts are opened at the same institution using the same passport number but different identities.

🚩Multiple accounts are opened with different identities and passport numbers but the same address, phone number, or email address.

🚩Accounts are funded via third party wires or cash deposits rather than income from employment.

🚩There is little or no normal daily spending on the account.

🚩The account receives wire transfers described as “tuition” or “living expenses,” but they do not correspond with the timing of these costs during the academic year, or the amounts do not correspondent with the expenses described.

🚩The account holder is unable to explain the source of the large cash deposits.

🚩Deposited funds are almost immediately withdrawn to purchase round-dollar cashier’s checks payable to third parties not associated with the account holder.

🚩The activity on the account following cash deposits shows indicators of money laundering, such as funneling.

🚩The activity on the account shows indicators of daigou, such as high-value credit card purchases of luxury items.

🚩There are changes in transactional patterns, device ID, or IP address which may indicate control of the account has been handed over.

Red flags that may indicate debt bondage, for example as a result of gambling debts, include:

🚩A customer is escorted and monitored while at the bank, for example by a person describing themselves as a “translator” or a “friend” who appears to be directing or controlling the customer, or is keeping the customer’s identity documents.

🚩An existing customer wants to open another account but the information they provide doesn’t match their existing account details.

🚩The same home address or phone number are shared by multiple customers.

Author

Catherine M. Woods is an Associate Managing Director at the Institute for Financial Integrity where she leads initiatives on countering cartels and Chinese Money Laundering Networks, illicit procurement networks and export controls, and emerging technologies including digital assets. For more information about our products and services, please contact info@finintegrity.org.

Many do not realize just how critical financial institutions are in preventing and disrupting human trafficking.

Join our upcoming webinar to hear from industry experts on the basics and nuances of human trafficking and related crimes, best practices and tips financial institutions can take to detect and investigate human trafficking and financially motivated sextortion, and the connections with professional money laundering.

AML/CFT and Sanctions Enforcement Actions in 2025

AML/CFT and Sanctions Enforcement Actions in 2025This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy