Operation Mouse

Catching Synthetic Identity Fraudsters in Canada

📅 October 8, 2025

📅 October 8, 2025

Financial fraud has existed almost as long as business, and the methods used by fraudsters continue to increase in sophistication, scale, and success. One method that is increasingly used to perpetrate fraud is synthetic identities, which use falsified or partially falsified information to open accounts or obtain credit, with the objective of subsequently committing fraud or furthering money laundering.

Key data from Canada and comparable jurisdictions includes:

Accounts opened using synthetic identities are subsequently used to perpetrate fraud, such as credit fraud, or to further other illicit activity as funnel accounts for money laundering.

Synthetic identities are fictitious or partially fictitious personal identities. They can be fully fabricated using invented names, birthdates, and other identities. Alternatively, they can use a combination of authentic and falsified information, such as a real Social Insurance Number (SIN) combined with a fake name. Often, the authentic data elements are used to create multiple different “mix-and-match” identities.

The increase in data breaches, which expose personal information, combined with a rise in artificial intelligence technologies such as deepfakes, provide the material needed to create synthetic identities, complete with realistic supporting information such as photographs, pay slips, bank statements, and phone bills. The result is fraud that ismore difficult to detect and more likely to be successful.

Financial institutions must be alert to the escalating use of synthetic identities and must take action accordingly. One Canadian bank achieved just that: identifying a network of synthetic identities that uncovered CA$25 million in fraud losses.

In Toronto, a bank teller noticed that a customer was attempting to open an account. A month earlier, the same customer had already opened a bank account at the same branch under a different name. The bank contacted the police. The man was arrested and in his wallet were 20 genuine identification cards under two fake names, two debit cards, a driver’s license, a social insurance card, and a citizenship card from the government of Canada. He had been promised CA$5,000 from his “handler” for each account he successfully opened.

His arrest led to a five-month investigation called Operation Mouse. Detectives discovered synthetic identities responsible for CA$25 million in fraud losses, representing unpaid credit card bills and mortgages.

That was in 2009. Since then, synthetic identity frauds have continued to increase in scale.

In 2024, Toronto detectives identified a synthetic identity scheme that had been in operation since 2016 and which had resulted in confirmed losses of more than CA$4 million.

More than 680 synthetic identities had been created, which were used to open hundreds of bank and credit accounts throughout Ontario. In many cases, payments were made into the credit accounts to enable them to be drawn beyond their defined overdraft limit.

Tracing the proceeds of the synthetic identity frauds, police identified identity documents and electronic templates to create false identifications and false documents. They also identified debit cards, credit cards, and charge cards obtained using the synthetic identities, as well as CA$300,000 in Canadian and foreign cash.

As of April 2024, police had arrested 12 people and made 102 charges in the ongoing operation.

Fraud schemes are not limited to one country. In an action brought by the U.S. Department of Justice, several defendants were convicted in 2017 of operating a fraud scheme using more than 7,000 synthetic identities. The fraud resulted in confirmed losses of more than US$200 million, with millions of dollars in proceeds wired to Canada, Japan, China, Pakistan, India, and the UAE.

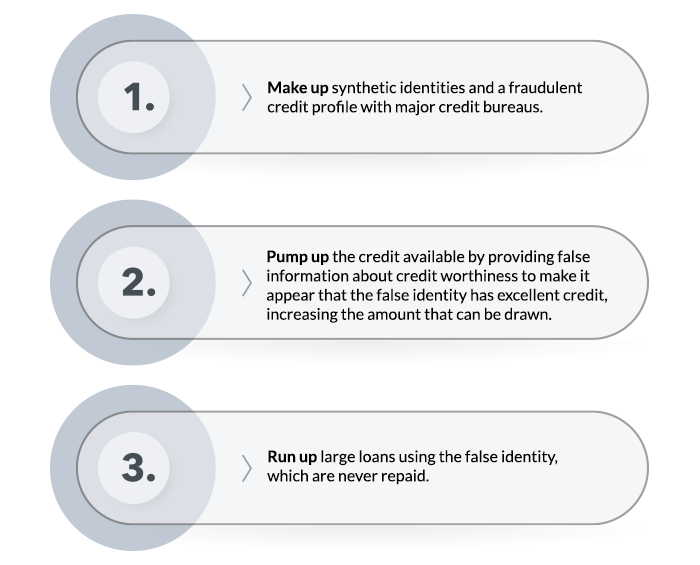

The fraudsters used a three step process called “make up”, “pump up”, “run up”, also called “bust-out fraud”;

Some indicators of synthetic identity fraud should be obvious. In one Canadian case, a person used a false identity to gain a driver’s license, bank accounts, telephone number, an apartment address, and a credit rating – all under the name “Server Froze”. Police suspected the person involved had limited English skills and, seeing what he believed was the name he was being directed to use by the operators of the fraud screen, wrote what was displayed on his computer.

In other cases, synthetic identity fraud schemes may operate over months or years. The financial activity appears to be that of a genuine customer: taking out credit and repaying it, resulting in more credit being extended. Finally, the fraud occurs: the fraudster maxes out their credit, often across multiple products – credit cards, lines of credit, loans – then defaults on all of them.

In a real-life example, fraudsters in Canada used synthetic identities and a synthetic company to obtain bank loans and insurance to purchase cement trucks. After making a few payments, they reported the trucks stolen and collected on the insurance. The fraudsters instead shipped the trucks to Dubai and sold them, adding to their illicit profits.

Unless financial institutions are alert to the possibility of synthetic identity fraud, such events may be recorded by the credit department as an operational loss. And if law enforcement pursues action against the person or company running the business, synthetic identities leave little behind.

The most critical action to identify and respond to synthetic identity fraud is to recognize the risk that it presents and to ensure measures are in place specific to synthetic identities, including the use of AI.

Synthetic identity fraud intersects teams including AML, fraud, cyber, and credit risk. To achieve an effective and unified response, the institution should establish joint working groups and data sharing.

As methods used by fraudsters continue to evolve, the institution’s anti-fraud programs must continue to adapt too. Relevant sources of information include internal investigations into potential fraud, law enforcement and regulatory advisories, and knowledge shared through public-private partnerships.

Sources of information should not be limited to one jurisdiction: best practices can be gained by tracking fraud trends and countermeasures globally. Some useful resources include:

Financial institutions could also consider implementing advanced analytics or AI solutions to help with their anti-fraud programs. These can help identify patterns and anomalies that may indicate fraud.

Synthetic identities and identity elements (such as a SIN or address) are often used to open multiple accounts. Financial institutions should conduct ongoing monitoring of all customers. For example, if new accounts are opened that have the same phone number or email address as an existing customer, it may indicate they are synthetic identities controlled by the same fraudster.

Where a credit loss occurs, or a fraud is identified, the institution should investigate the account history and account opening documents to identify indicators of synthetic identities and/or wider fraud.

Related accounts or those with similar characteristics should also be investigated, such as credit cards where balances have been paid off from the same external account. This may indicate they are in the process of building up credit ahead of a “bust-out” fraud.

Institutions should provide staff with training customized for their role. Customization enhances relevance and knowledge retention. For example, customer-facing staff should be trained to identify synthetic identities or documents, whereas investigative teams should be trained to effectively identify wider fraud schemes.

Institutions can also help their customers avoid being victims of identity theft. Resources such as the Canadian Government’s ITSAP.00/003 Protecting yourself from identity theft online provide a starting point as well as actions individuals can take if their identity has been compromised.

Synthetic identities are usually used to open accounts across multiple institutions: this maximizes the potential fraudulent gains from each synthetic identity. Financial institutions should report synthetic identities, frauds, and suspicious activity in accordance with their jurisdictional requirements. Where permitted, they should also share intelligence with other financial institutions.

“Fraudsters are using sophisticated technology to create scams that feel more real than ever… The more we learn about their tactics, the less chance criminals have to defraud us.”

– Matthew Boswell, Commissioner of Competition, Competition Bureau Canada

Our course Foundations of Anti-Fraud offers a comprehensive overview of various definitions of fraud, its risk factors, and prevention strategies. Through a series of videos and interactivities, learners will acquire the foundational knowledge necessary to recognize fraud and implement effective strategies to combat it.

Learn more and strengthen your team’s compliance skills today.

The Illusion of Preparedness

The Illusion of PreparednessThis site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy