Canada’s Strong Borders Act

A New Era in Financial Crime Compliance

📅 July 8, 2025

📅 July 8, 2025

On June 3, 2025, Canada introduced Bill C-2, also known as the Strong Borders Act. This sweeping piece of legislation proposes significant reforms to Canada’s anti-money laundering (AML) and counter-terrorist financing (CTF) regime. The bill aims to strengthen enforcement tools, expand regulatory coverage, and push Canadian financial institutions and other reporting entities to modernize their compliance programs.

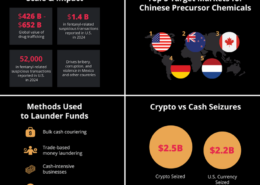

These proposed changes come at a critical time. In the past year alone, Canada has seen heightened scrutiny of its AML controls, especially in the wake of the TD Bank scandal in the United States, where the bank paid over $3 billion in penalties for AML deficiencies, including failing to stop drug cartel-linked money laundering. In parallel, the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) has issued a string of high-profile enforcement actions against major financial institutions.

Bill C-2 introduces a number of notable amendments to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). These changes are designed to tighten supervision, increase transparency, and improve compliance outcomes.

One of the most striking changes is the dramatic increase in administrative monetary penalties (AMPs). Under the new proposal, maximum fines for minor violations will rise from $1,000 to $40,000, while penalties for serious violations will increase from $100,000 to $4 million. For very serious violations, the ceiling will be lifted from $500,000 to $20 million, or 3 percent of global revenue, whichever is greater. The penalty cap per violation will be set at $20 million, signaling a major shift in enforcement strategy.

The bill also proposes mandatory enrollment for all reporting entities with FINTRAC, along with periodic renewals to maintain registration. This change aims to ensure ongoing compliance oversight and prevent dormant or inactive entities from falling through the cracks.

Another headline reform is the proposed ban on accepting large cash payments. Under the new rules, businesses, charities, and other entities would be prohibited from receiving cash payments of $10,000 or more in a single transaction. Similarly, financial institutions would face stricter controls around third-party cash deposits, which are often used to mask the source of funds in laundering schemes.

The legislation also introduces mandatory compliance agreements. While voluntary agreements have long been used to correct AML deficiencies, the new model will make them legally binding. Failure to meet the terms of these agreements could result in escalating penalties, with maximum fines reaching $30 million.

In addition to the new obligations, Bill C-2 proposes to bring more entities into the regulatory fold. Factoring companies, leasing and financing firms, and cheque-cashing businesses would all become subject to AML obligations. These sectors have traditionally operated with limited oversight, despite their known vulnerability to misuse by money launderers and fraudsters.

The bill also links compliance duties to Canada’s federal beneficial ownership registry, which launched in January 2024. Starting in October 2025, reporting entities will be required to notify discrepancies between client records and the registry. This alignment is intended to close gaps in ownership transparency and reduce the use of shell companies to obscure illicit funds.

In a bid to improve intelligence gathering and coordination, Bill C-2 also enhances information-sharing capabilities. Public-private and private-private information exchange will be permitted between reporting entities, subject to appropriate privacy safeguards. The hope is that this will allow faster detection of complex financial crime patterns that span institutions and sectors.

Bill C-2 builds on several recent initiatives designed to modernize Canada’s financial crime regime. The introduction of the beneficial ownership registry was a major step forward, especially as provinces such as British Columbia and Quebec roll out their own transparency requirements.

The Canada Border Services Agency (CBSA) has also been given new tools to combat trade-based money laundering. With Canada playing a key role in global trade, enforcement agencies are seeking to disrupt the flow of illicit funds hidden in import-export schemes.

In February 2025, the federal government launched the Integrated Money Laundering Intelligence Partnership (IMLIP), a platform that brings together banks, law enforcement, and regulators to share intelligence on high-risk transactions and typologies. FINTRAC is also investing in artificial intelligence tools to improve real-time monitoring and detection of suspicious activity.

Should Bill C-2 pass, its practical impact on Canadian reporting entities will be substantial. Organizations will face a higher risk of enforcement, more detailed compliance obligations, and greater expectations around transparency and reporting. Institutions that have historically relied on a reactive or check-the-box approach to compliance will need to pivot toward more proactive, risk-based strategies.

Compliance programs will need to evolve quickly to meet updated requirements. This includes updating risk assessments, customer due diligence processes, and transaction monitoring systems. With cash transaction bans and beneficial ownership verification becoming front-line priorities, financial institutions and other reporting entities will need to ensure their systems can identify and flag potential issues in real time.

Internal governance will also need attention. Boards and senior management will be expected to demonstrate awareness of their AML/CTF responsibilities, with clear oversight structures in place. Given the expanded penalties and public scrutiny, it will be essential to foster a strong compliance culture throughout the organization.

The information-sharing provisions of Bill C-2 also introduce new challenges. Entities will need to develop internal procedures to exchange risk intelligence responsibly while also respecting privacy rights and data protection standards. Coordination with privacy regulators and legal teams will be key to ensuring that new collaboration models do not expose firms to additional liability.

With global expectations for stronger compliance, Canada is moving decisively to raise its standards. Bill C-2 signals a new era of enforcement, oversight, and transparency in the fight against financial crime. The Strong Borders Act is a call to action for Canadian institutions to step up their financial integrity game before regulators, law enforcement, or the headlines do it for them.

Designed for all employees of financial institutions, our flagship eLearning course reviews the concepts of money laundering and terrorism financing as well as global standards, primary regulatory bodies, and enforcement actions.

Reach out to our team to schedule a demo.

A Necessary Shift in Mindset

A Necessary Shift in MindsetThis site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy