The Green Gold Rush

Corruption Risks in the Green Transition Mining and Minerals Industry

📅 January 13, 2025

📅 January 13, 2025

In the past five years, the market size for the minerals needed for a green energy transition, such as lithium, cobalt, copper, nickel, and rare earth minerals, has doubled, and production of these minerals is projected to increase by nearly 500% by 2050. As demand for low-carbon technologies like electric vehicles and solar panels continues to soar, accessing the transition minerals that fuel these technologies has become a modern-day “gold rush” for companies willing to navigate this new landscape. However, the astronomical growth in the green energy sector can come with a steep price for firms and financial institutions that are unprepared to navigate its risks.

Specifically, corruption and bribery, if not addressed and mitigated, can result in severe penalties under domestic and international anti-money laundering (AML) and anti-corruption regulations, possible legal action, and reputational damage.

Financial institutions, investors, and other businesses involved in commodity trading act as key enablers of the transition mineral economy. Their involvement in funding mining projects, facilitating trade, and underwriting supply chains positions them as essential players in the race for clean energy solutions.

From mining corporations to financial institutions managing transactions and the agents, contractors, and intermediaries facilitating deals, those operating in the transition mineral supply chain face significant corruption risks. Doing business in this sector often requires navigating government gatekeepers and opaque bureaucratic procedures, and operations are often limited to resource-rich jurisdictions where transition minerals are highly concentrated but that are often at higher risk for corruption.

Countries that experience sudden wealth from natural resources often struggle to match the pace of their booming commodity market with adequate anticorruption institutions or regulatory safeguards. These are serious problems for firms and financial institutions that transact in these sectors, as every interaction with foreign government agencies and officials can increase the risk of bribery and corruption and could result in possible fines or other punitive actions.

Therefore, it’s vital that all businesses, investors, and financial institutions are aware of the risks present at every stage of the transition mineral supply chain and take steps to mitigate these risks.

Strong Correlation between Energy Transition Minerals and Corruption

As the world races to meet growing demand for green technologies that use energy transition minerals, it has created an unpredictable regulatory environment and enhanced risks for businesses, and regulators are struggling to stay ahead. The mining and metals sector has long been prone to bribery and corruption risks in part due to its reliance on government permits, large-scale contracts, and operations in high-risk regions. Moreover, commodity booms often heighten such risks, as many new actors rapidly enter the supply chain with varying degrees of risk appetite and compliance practices. This volatile combination contributes to the high-risk of the transition mineral industry.

Source: Transparency International Accountable Mining Programme

High Risk Jurisdictions and State Involvement

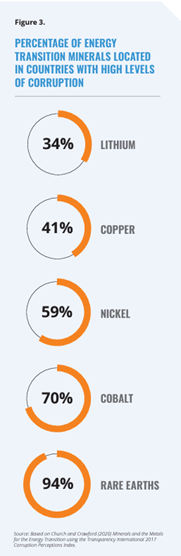

A major factor that can help determine whether an industry is at a high risk for corruption and bribery is its concentration in jurisdictions known for corruption and lax regulatory oversight. Key energy transition mineral reserves are often disproportionately concentrated in countries with weak governance and high levels of corruption. According to anti-corruption NGO Transparency International, 70 percent of cobalt, 59 percent of nickel, and 94 percent of rare earth minerals are located in countries considered highly corrupt by the organization’s Corruption Perceptions Index. An example is the Democratic Republic of the Congo, which ranks as one of the top 20 most corrupt countries in the world, and produces more than half the world’s cobalt, while raising numerous corruption red flags for its informal mining sector and child labor exploitation.

Interacting with government officials or state-owned mining enterprises is a nearly unavoidable aspect of the mining and metals industry, as governments have the authority to oversee the operations of foreign businesses and approve mining projects. However, in highly corrupt countries, proceeds from natural resource commodities are frequently diverted as rents—or public financial benefits used for private gain—by public officials, and bribery often occurs during licensing and contract allocation processes. Even if bribery or fraud problems do not arise in every situation, there is reputational risk for financial institutions that interact with government agencies or state contractors suspected of corruption.

Complex Networks and Middlemen

Corruption and bribery risks in the minerals and mining sector are significantly heightened by the pervasive role of intermediaries. Intermediaries in the extractive industry often include traders, business development agents, consulting firms, brokers, and many others. These entities play roles in securing government contracts, facilitating permits, and creating links to politically exposed persons (PEPs), frequently exposing financial institutions to significant compliance risks for failing to meet their anticorruption regulatory obligations related to PEPs. For example, a 2019 Stanford Law School study of 275 Foreign Corrupt Practices Act (FCPA) enforcement actions revealed that nearly 90 percent involved third-party intermediaries, and the OECD found that intermediaries played a significant role in three-quarters of 427 foreign bribery cases.

When dealing in the minerals and mining sector, it’s vital to be aware of the red flags that increase the risks of corruption, bribery, and other illicit activity surrounding the proceeds of green transition minerals. Indicators of these risks in the transition minerals sector share similarities with broader corruption and bribery red flags but are increased by the sector’s high-level of exposure and status as an emerging market. Financial institutions, other government agencies, or Designated Non-Financial Businesses and Professions (DNFBPs) in the transition energy minerals sectors should watch for the following indicators:

🚩Ties to governments, public officials, or state-owned enterprises

The Financial Action Task Force (FATF) warns financial institutions and DNFBPs that customers who are “politically exposed persons” (PEPs) greatly increase corruption risks. PEPs include current or former senior political figures, their immediate families, and known close associates. In the transition minerals sector, red flags that may indicate a PEP include large money transfers linked to industry accounts or the frequent involvement of their close associates in the industry.

🚩Unnecessary or unqualified middlemen

Assess the customer’s third-party risk management policy and determine the extent to which they rely on intermediaries. Also consider the background and qualifications of third parties and their links to foreign officials. The reliance on intermediaries is heightened in transition minerals due to fragmented and international supply chains, particularly in jurisdictions with weak government institutions.

🚩Prices, fees, or discounts that are unusually high compared to the market rate

Warning signs may include over-invoicing, false invoices, and unrecorded or vague transactions. Transition minerals are more susceptible to pricing irregularities due to their value in emerging markets which do not yet have well-defined global benchmarks for pricing.

🚩Collusive bidding or uncompetitive selection

Information indicating undue influence or collusion in the contract bidding process may suggest the presence of corruption. High global demand for transition minerals has intensified competition for access, making collusive behavior more lucrative and harder to detect.

🚩Unusual contract terms

Client, customer, or third-party requests for unusual contract terms or proposing the use of specific agents.

🚩Weak government control over institutions and resource management

Systemic governance failures and large informal operations often indicate the presence of corruption in transition mineral-producing countries. This is especially evident in many countries with high levels of transition mineral concentration, including in the Democratic Republic of Congo, which struggles to contain small-scale mining operations and child labor abuses. Moreover, private military companies like U.S.-designated Wagner extract revenue from this industry through security contracts or direct control of mining sites, exposing sector participants to sanctions violations.

Because of the transition mineral sector’s inherently higher risk of bribery and corruption, companies that operate in energy transition mineral industry must implement robust Anti-Bribery and Corruption (ABC) programs that address specific industry risks.

Corruption and bribery risks weave through every layer of the transition mineral supply chain, challenging even the most experienced professionals to mitigate exposure according to the organization’s risk appetite. Financial institutions, government agencies, and other businesses that fund and participate in the transition metals sector must prioritize the implementation of effective anti-corruption and bribery programs tailored to the high-risk jurisdictions and industries involved, with enhanced due-diligence accounting for greater exposure to public officials and complex supply chains. A commitment to robust compliance is essential for maintaining financial integrity in this high-risk sector, as well as for preserving momentum towards a more sustainable future.

Sign up for the Dedicated Online Financial Integrity Network (DOLFIN). A powerful resource for industry professionals, membership grants unlimited access to our extensive library spanning the core financial integrity topics.

Syria Sanctions Relief

Syria Sanctions ReliefThis site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy