Cartels & Crypto

How Cash Is No Longer King

📅 July 17, 2025

📅 July 17, 2025

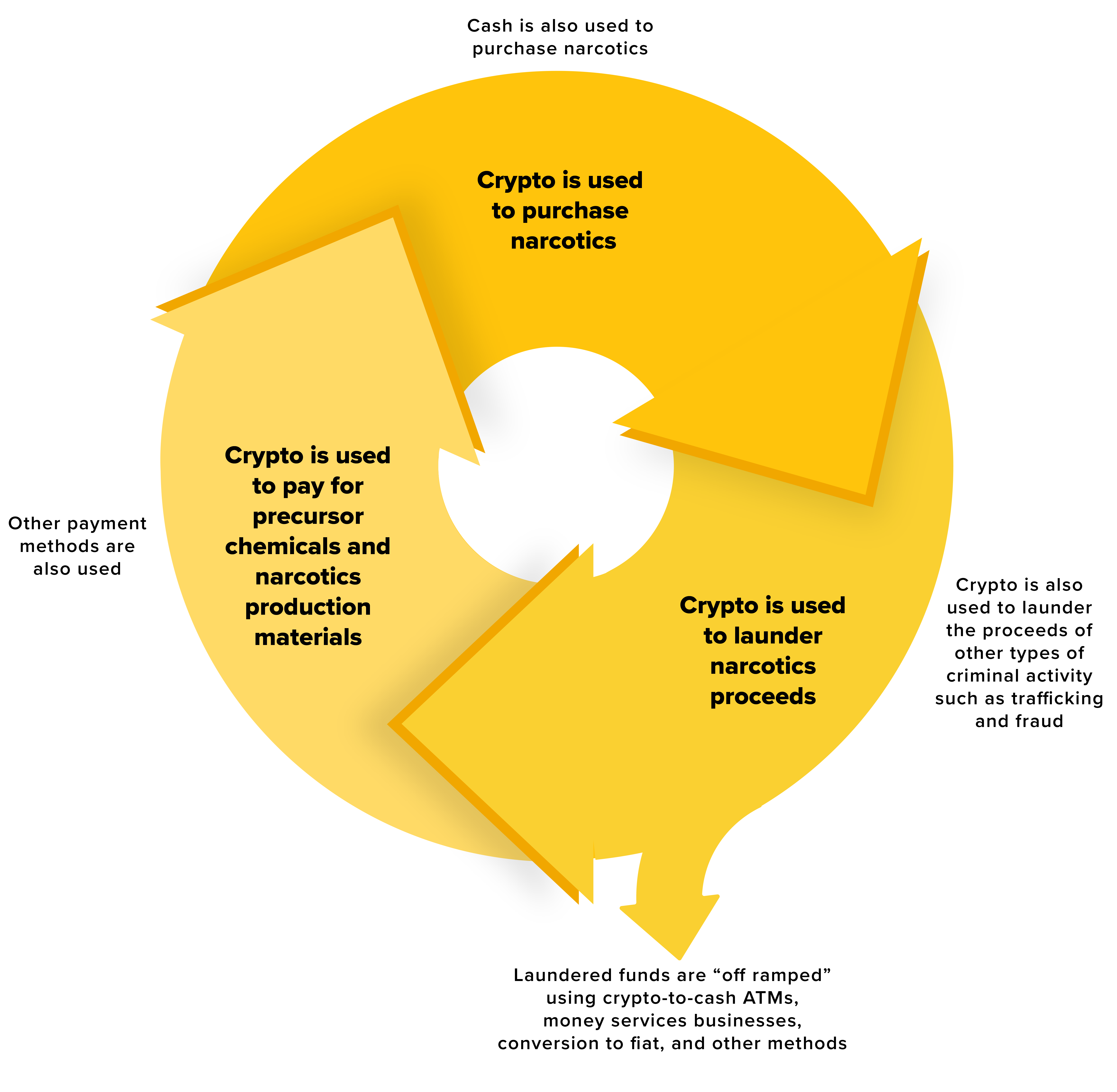

Cartels and the professional money launderers that service them have integrated digital assets throughout the narcotics trade. To effectively identify risk indicators, financial institutions including crypto businesses must understand how crypto is used by cartels and money launderers, and the red flags applicable to their specific type of business.

Crypto is increasingly king when it comes to money laundering by cartels. From 2020-2024 in the United States, $2.5 billion in crypto was seized compared with $2.2 billion in U.S. currency, according to the DEA. However, cartels – and the Chinese Money Laundering Networks who are key enablers of their business – continue to adapt their methodologies.

Cartels such as Sinaloa and CJNG have integrated digital assets into their operations throughout the narcotics “product lifecycle”:

China is the primary country of origin for the precursor chemicals used to manufacture narcotics for distribution in the United States, according to the DEA. Digital assets are widely accepted as a form of payment: 97% of more than 120 Chinese precursor manufacturers accepted payment in digital assets, according to an assessment using blockchain analytics.

The use of crypto to pay for precursor chemicals is increasing: payments in crypto to Chinese precursor manufacturers increased more than 600% from 2022 to 2023, reaching more than $26 million, and more than doubled in the first four months of the following year.

The digital assets used for payment are primarily Bitcoin (60%), stablecoin Tether (USDT) on the Tron blockchain (30%), and USDT on the Ethereum blockchain (6%).

Precursors are shipped to countries such as Mexico to manufacture narcotics, which are then transported to the United States for distribution and sale.

Payments for narcotics like fentanyl are often made in cash. Payments may also be made directly in crypto, for example when narcotics are purchased on a darknet marketplace.

Multiple methods are used to launder the proceeds from narcotics sales, including use of the traditional financial system, “mirror trades” enabled by Chinese Money Laundering Networks, trade-based money laundering, and other methods. Increasingly, crypto is used for laundering.

Cash proceeds are converted to crypto as part of the laundering process, either directly using cash-to-crypto ATMs, or the cash may be deposited into bank accounts by money mules and later converted to digital assets. The assets are primarily Bitcoin and stablecoin USDT, although others may also be used such as USD Coin (USDC), Ripple (XRP), and Ether (ETH). Stablecoins are digital assets that are “pegged” to a fiat currency, usually USD, and they therefore offer lower volatility compared with Bitcoin. The crypto can then be rapidly moved, including across borders, to cartel-controlled wallets. Often, the proceeds of narcotics trafficking are comingled and laundered with the proceeds of other criminality such as fraud (refer to the box for an example).

To complete the narcotics trading cycle, the crypto may be used to acquire more precursor chemicals, or it may be cashed-out at crypto ATMs, through money services businesses (MSBs), or converted into fiat currency, often at a discount given its criminal origin.

In September 2023, OFAC designated Mario Alberto Jiminez Castro, stated to be a member of the Los Chapitos faction of the Sinaloa Cartel. Jiminez Castro arranged for U.S.-based couriers to collect cash in the United States and deposit it into digital asset wallets for payment onwards to the cartel for reinvestment in fentanyl production. OFAC also designated a “cryptocurrency address” (wallet) which received $740,000 from March 2022 to February 2023. These designations marked the first time OFAC publicly identified that cartels use crypto to launder drug proceeds. Although crypto was not used to pay for the narcotics, it was used to launder the proceeds.

In January 2024, Martin Mizrahi was convicted of laundering more than $4 million in proceeds from illegal narcotics and fraud and $8 million in bank and credit card fraud. From February to June 2021, Mizrahi accepted bulk cash which was the proceeds of narcotics sales. He converted it into bitcoin and layered it through multiple crypto wallets specified by cartels. Indicative of the intersection between multiple types of criminality, Mizrahi was also convicted for laundering the proceeds of business email compromise fraud and other types of fraud, as well as narcotics proceeds.

Source: United States Attorney’s Office and TRM Labs

Financial institutions including crypto businesses should already have well-established counter illicit finance programs including Know Your Client (KYC), transaction monitoring, data analytics to identify anomalous activity, and organizational and governance structures. Blockchain technology, which underpins many types of digital assets, provides additional tools to identify red flags that may indicate professional money laundering using digital assets.

Blockchain analytics can be used by financial institutions offering crypto products, servicing crypto businesses, or otherwise associated with digital assets markets.

Red flags specific to the use of digital assets in the narcotics trade and laundering the proceeds include:

🚩 Rapid movements in or out of a suspected account over short periods of time

🚩 Deposits into crypto accounts (purchases or transfers-in of crypto) that are quickly moved out leaving a zero or almost-zero balance

🚩 “Funneling” or “pooling”, especially if “gas fees” are funded as a single payment covering multiple deposits and withdrawals (see detail below)

🚩 Swaps between different digital asset chains (e.g. receiving tokens on the Tron blockchain and withdrawing tokens on the Ethereum blockchain)

🚩 High volumes of transactions between accounts/wallets with red flags (e.g. those where the wallet owner’s ip address indicates they access the account from a geographical area with a high risk of cartel activity)

🚩 Transactions with wallets already identified by blockchain analytics tools as being associated with narcotics trafficking or other illicit activity

How Gas Fees Can Indicate Pooling of Illicit Proceeds

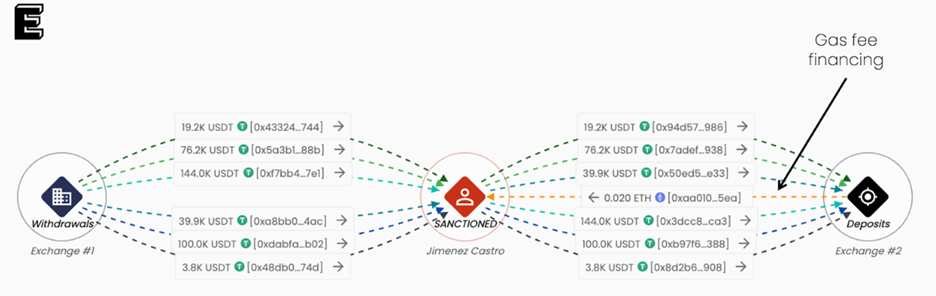

Blockchain analytics can be used to trace digital asset transactions. Like money laundering through the fiat financial system, crypto transactional activity may indicate “pooling” or “funneling”, which is a red flag for money laundering. To identify pooling, blockchain analytics can be used to identify specific patterns associated with “gas fee” payments.

“Gas fees”, meaning the processing fees for blockchain transactions, are also visible as a blockchain transaction. Where the gas fee for multiple deposits and withdrawals are financed as a single payment, often in Ether or Tron, it reveals an association between the transactions.

The example below shows how Jiminez Castro, described above, operated wallets to funnel value using stablecoin USDT. For example, 19.2K USDT is deposited in his wallet and later 19.2K in USDT is withdrawn. The same pattern applies to other deposits and withdrawals shown below. Each deposit/withdrawal pair is assessed as being a separate pick-up job (e.g. collection of bulk cash proceeds from narcotics sales) and the amounts are matched before and after pooling in Jiminez Castro’s wallet. The processing fees for the transactions are paid as a single combined payment, shown in orange and in the reverse direction. This indicates that all the transactions covered by the gas fee payment are related.

Source: Elliptic

Digital assets aren’t just used in the fentanyl industry; they are used by organized crime groups and launderers in other illicit activities too. For example, digital assets may be used in human trafficking and people smuggling including:

Government, law enforcement, and intelligence communities, and financial institutions including crypto businesses, should be alert to the evolving use of crypto for financial crime.

The Institute for Financial Integrited hosted an educational webinar on the emergence of Chinese money launderings networks as a key enabler for laundering cartel proceeds and other criminal finances.

Out of the Shadows

Out of the ShadowsThis site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy