Electronic Fund Transfer Consumer Protection

Potential Equalizing Measures for Crypto

📅 February 5, 2026

📅 February 5, 2026

As economies and financial systems modernize, so do the ways consumers interact with the financial system. For example, the transition from physical checks to electronic banking provided new products and services such as debit card transactions, electronic withdrawals and transfers, deposits through ATMs, and remote banking. While these provide greater speed, efficiency, and accessibility for consumers, they also present new possibilities for errors and fraud.

The Electronic Fund Transfer Act (EFTA) was established to protect consumers using electronic fund transfers by establishing the duties, rights, and responsibilities of consumers and financial institutions. EFTA is implemented through Code of Federal Regulations Part 1005, also known as “Regulation E”.

Regulation E applies to any electronic fund transfer that authorizes a financial institution to debit or credit a consumer’s account. “Consumer accounts” are defined as those established primarily for “personal, family, or household purposes” and include checking and savings accounts.

Provided these requirements are met, products and services that are within scope of Regulation E include:

Some activities are specifically excluded from coverage under Regulation E including:

The Regulations set out three core protections:

Clear and timely disclosures: Institutions must provide clear information about the types of transfers consumers can make, the fees, any limitations on amount or frequency, how to report unauthorized transfers or errors, and consumer liability for unauthorized transfers. This must be provided at the time the consumer engages the services or before the first fund transfer is made.

Limited consumer liability for unauthorized transfers: Consumers may only be held liable where the institution has provided clear and timely disclosure (see above). There are also additional protections for consumers depending on how quickly they notify the financial institution of unauthorized activity.

Where there has been loss or theft of the consumer’s “access device” (usually this means their debit card):

Where the card was not lost or stolen, the consumer is not liable for any unauthorized charges provided they report the unauthorized activity within 60 days of the statement being sent.

Fair error resolution procedures: Financial institutions must promptly investigate errors and correct them within one day of determining that an error occurred. Usually, the institution has 10 days to complete its investigation, however this may be extended to 45 days provided the institution provisionally credits the consumer account with the amount of the alleged error while the investigation is ongoing.

Examples of errors include unauthorized transfers, incorrect transfers to or from the consumer’s account, or transfers that are missing from their periodic statements. Errors do not include routine inquiries about the consumer’s account balance or requests for information for tax or other purposes, or requests for duplicate copies of information.

These are a summary of key provisions relating to consumer liability and protection – refer to the EFTA and Regulation E for complete information.

Until recently, the EFTA and Regulation E did not apply to most digital asset transactions. Consumers using crypto wallets, stablecoins, or blockchain-based platforms for purchases or peer-to-peer transfers operated largely outside the traditional protections described above. However, this may change.

In January 2025, the Consumer Financial Protection Bureau (CFPB) issued a Proposed Interpretive Rule aimed at modernizing how Regulation E applies to emerging digital payment systems. The objective of the proposed rule is to ensure consistent application of the EFTA and Regulation E, and to avoid placing some providers at an unfair competitive disadvantage.

The proposed rule would extend the scope of EFTA and Regulation E, including:

The effect of the proposed changes would bring digital asset services and providers into scope of the consumer protections set out in EFTA and Regulation E.

These proposed changes are relevant for platforms that facilitate purchases using stablecoins or other digital tokens, allow peer-to-peer transfers within wallet environments, or offer consumer-facing payment services integrated into apps or gaming platforms.

Some crypto platforms have already begun offering EFTA-like protections voluntarily, such as:

Adopting these safeguards now may help organizations prepare for future regulatory requirements, as well as to build consumer trust and confidence.

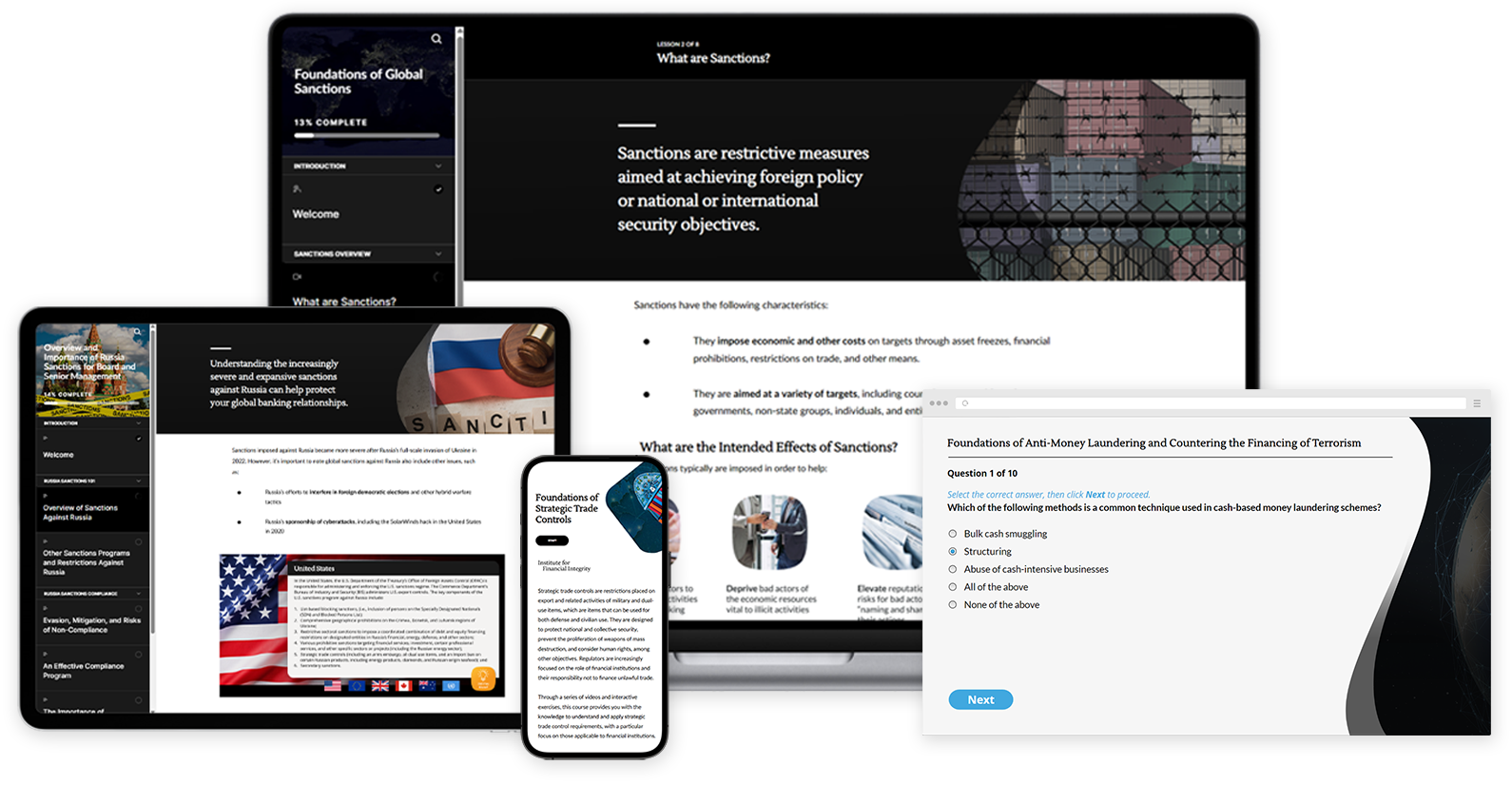

Whether looking to revamp an annual compliance course or to develop a new instructor-led program covering emerging threats, IFI can design, develop and deliver training tailored to your organization’s unique needs.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy