Why and How Standardized Training Falls Short

The disconnect between training and real-world risk

📅 February 18, 2026

📅 February 18, 2026

Generic compliance training is designed for an average institution that does not really exist. It assumes a standard business model, a simplified risk profile, and neat, hypothetical decisions that rarely resemble the reality of how work gets done. Employees sit through content that feels distant from their day-to-day responsibilities. Senior management gets high level overviews that don’t quite translate into meaningful oversight. Boards hear about risk in broad terms, without a clear connection to where the institution is exposed.

The result is learners complete training that does not carry into real situations.

What this really means is that training becomes passive. It checks a box, but it does not change behavior, improve judgment, or hold up well when regulators start asking harder questions.

As institutions expand into new products, new jurisdictions, and new technologies, that disconnect only grows. Risks become more complex, but the training meant to address them stays static.

When training fails to reflect how an institution actually operates, it sends the wrong signal. It suggests compliance lives in theory, not in daily decision-making. Regulators have been increasingly clear that this approach is no longer enough.

Generic compliance training usually does not fail in obvious ways. Learners complete it. Systems show full participation. Nothing looks wrong, until a review, an exam, or an enforcement action exposes the gaps.

Those gaps tend to show up in the same places repeatedly.

Employees finish the training, but struggle when they it comes time to apply it. Red flags feel vague. Escalation points are unclear. People understand the rules on paper, but not how to act when information is incomplete or business pressure is high.

High-risk functions receive the same content as low-risk roles. Over time, this dulls risk awareness and leaves critical teams underprepared for the complexity they face every day.

Training for senior management and boards often lands at the extremes. It is either too technical to support meaningful oversight or at a bird’s eye view that offers little practical value. The result is leadership without clear sight of where the institution is most exposed or how accountability sits.

Generic programs are slow to change. New products, new markets, and emerging threats are treated as add-ons rather than integrated into the core training approach.

Regulations are explained, but internal policies, procedures, escalation paths, and governance structures are not reinforced in a practical way. This weakens consistency and makes controls harder to rely on.

Completion rates become the main proof point. When regulators ask how training supports risk management and decision-making, institutions have little to show beyond attendance records.

As a result, generic training can create a false sense of comfort. The institution may appear compliant on paper, but employees and leaders are not equipped to manage risk when it matters.

These breakdowns are rarely about effort or intent. They happen because the training was never designed to reflect the complexity, variation, and accountability that define modern financial institutions.

Every compliance program starts with the same basic idea: risk depends on context. But training often ignores that reality, as if all institutions operate the same way and face the same threats.

In practice, risk is shaped by a long list of factors that look different at every firm. Business model, customer base, products and services, delivery channels, geographic reach, regulatory obligations, and growth plans all influence where risk actually shows up. Two institutions can be subject to the same regulations and still face very different exposure.

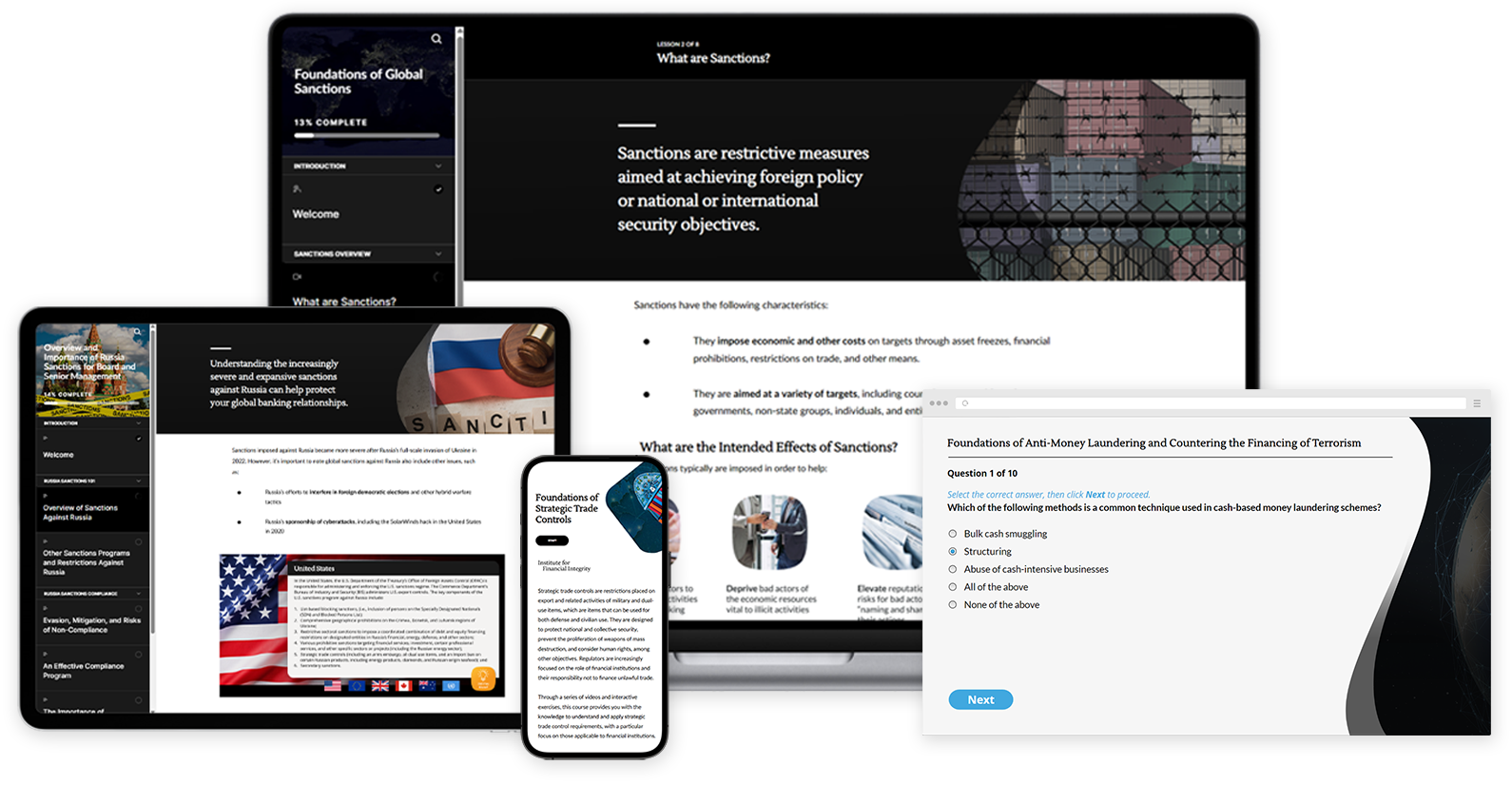

This is why at IFI, all our off-the-shelf courses are built to be a springboard for customization. Tailoring training to an institution’s specific needs should be taken into consideration at the outset of program development.

You see this quickly when you look at how institutions operate. A retail bank focused on domestic deposits does not manage risk the same way as a bank with global correspondent relationships. A fintech offering embedded payments faces different fraud and AML challenges than a traditional broker dealer. An institution moving into digital assets or cross border services takes on new regulatory expectations and enforcement risk, often before internal processes fully mature.

Geography adds another layer. Operating across multiple jurisdictions means navigating different sanctions regimes, customer due diligence standards, reporting thresholds, and data privacy rules. These obligations are not interchangeable. Training that treats them as if they are leaves employees guessing when decisions need to be made in real-time.

Risk doesn’t reside in policies or risk assessments. It shows up in everyday moments: onboarding a customer, reviewing a transaction, deciding whether to escalate an issue, or setting the tone at the management level. When training does not reflect these realities, employees are left to bridge the gap themselves, which leads to inconsistency and avoidable mistakes.

Generic training cannot capture these nuances. It explains the rules, but not how those rules apply to the institution’s actual activities. It highlights risk in theory, without focusing on where the institution is most exposed in practice.

Recognizing that no two institutions share the same risk profile is the starting point for effective training. Without that recognition, even well-intentioned programs will struggle to support the decisions, behaviors, and accountability regulators expect to see.

At the Institute for Financial Integrity, we design custom compliance training that reflects how institutions actually operate, across products, jurisdictions, and lines of defense. Our programs support frontline execution, management oversight, and board-level accountability, and are designed to meet regulatory expectations in practice, not just on paper.

At the Institute for Financial Integrity, we design custom compliance training that reflects how institutions actually operate, across products, jurisdictions, and lines of defense. Our programs support frontline execution, management oversight, and board-level accountability, and are designed to meet regulatory expectations in practice, not just on paper.

Stay tuned for our next article in this series, What Effective Compliance Training Looks Like, in which we break down what customization means in practice. Not logos and slide edits, but training aligned to risk assessments, built around real scenarios, and designed to hold up under regulatory scrutiny.

If you’re reassessing whether your current training program truly supports risk management and oversight, this is where the conversation starts. Learn more about our custom training services by clicking on the button below.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visit to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Privacy Policy