What Effective Compliance Training Looks Like

Custom compliance training is often misunderstood as light tailoring. This article explains what real customization looks like in practice, from risk-aligned content and role-specific learning to training built around real decisions, controls, and regulatory expectations.

Why and How Standardized Training Falls Short

Today’s financial institutions operate across different products, jurisdictions, and threat environments. This article examines why standardized training falls short and where generic programs consistently break down in practice.

Wynn or Lose

Casinos have long been associated with money laundering and organized crime. Explore the recent Wynn Las Vegas $130 million forfeiture as a case study, including threats such as Chinese Money Laundering Networks, mirror transfers, proxy gambling, and the use of shell companies.

Electronic Fund Transfer Consumer Protection

The Electronic Fund Transfer Act (EFTA) was established to protect consumers using electronic fund transfers. Explore what is considered in scope and the changes proposed to include crypto.

Following the Illicit Funds

As crypto grows, so does regulatory oversight. From SARs and CTRs to MSB registration and potential FBAR requirements, crypto businesses are now firmly within the scope of financial regulations.

Blind Spots in the System

When transaction monitoring fails, the cost goes far beyond fines. This article explores why many programs still miss critical red flags and how effective training helps teams to strengthen detection, calibration, and oversight where it matters most.

Top 10: Cartel Finance & Chinese Money Laundering Networks

The Institute for Financial Integrity has identified the “Top 10” list of actionable resources for financial institutions to use to detect and respond to cartel finance and CMLNs. These can inform policies, processes, systems, controls, and training programs.

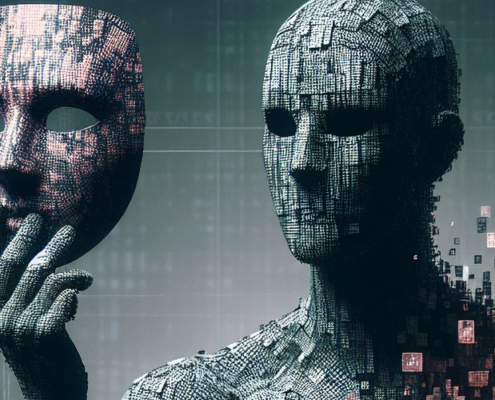

Synthetic Identities

Fraud generates billions in proceeds every year, and the use of AI significantly increases the speed, scale, and likelihood of success. Synthetic identities are already leveraged to open accounts used to commit fraud and launder money. Explore red flags and actions financial institutions must take to detect and respond to AI-enabled synthetic identities.

When Holiday Cheer Meets Fraud Pressure

This article breaks down the key scam patterns emerging this season, why December has become a true test of institutional readiness, and the steps teams can take to reduce losses and respond with confidence.

Where Boards and Senior Management Fall Short on Compliance Oversight

From passive oversight and overreliance on compliance officers to blind spots in risk awareness and a check-the-box only training culture, senior management often stumbles in ways that invite regulatory scrutiny. This article explores the most common pitfalls and how leaders can avoid them to strengthen accountability at the top.