Out of the Shadows

Iran’s shadow banking system has laundered billions of dollars for the regime. In this article, we detail how the system works and how financial institutions can identify red flags associated with Iran’s oil smuggling and concealed payment networks.

Cartels & Crypto

Cartels and the professional money launderers that service them have integrated digital assets throughout the narcotics trade, from precursors to sales and laundering proceeds.

Canada’s Strong Borders Act

Canada’s Strong Borders Act represents a sweeping overhaul of the country’s AML/CFT regime. The legislation introduces tougher penalties, expanded oversight, and stricter compliance and enforcement expectations.

A Dangerous Alliance

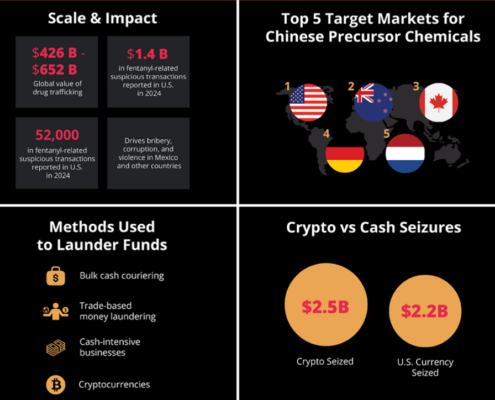

Today, on United Nations International Day Against Drug Abuse and Illicit Trafficking, we spotlight a dangerous financial alliance accelerating the fentanyl crisis: transnational partnerships between Mexican cartels and Chinese money laundering networks.

From Fraud to Flow

Fraud is often the entry point into a complex web of financial crime from money laundering to terrorism financing. Understanding this gateway role is essential for those defending the integrity of the global financial system.

The Network, Not the Node

Data analytics and advanced technologies are critical tools to take effective action against increasingly complex criminal networks. In this article we consider the best practices a financial institution could apply when implementing data analytics strategies and solutions, and what the future holds.

Sweeping AML Requirements for RIAs and ERAs

FINCEN issued a final rule with new AML requirements for investment advisers. With the January 1, 2026 deadline approaching, RIA and ERA firms must begin building and implementing their compliance programs as soon as possible.

Cartels, Cash, and Capital Flows

Cartels and their money laundering networks represent an increasing threat to our security and citizens, as well as being a priority for enforcement action. This article sets out five actionable steps a financial institution can take to ensure it is effectively identifying and responding to cartel risk.

Navigating the Convergence of Sanctions & AML Regimes

In our recent webinar, the director of compliance and enforcement at OFAC and three financial integrity industry leaders discussed the importance of breaking down silos and shared other advice for AML/CFT and sanctions professionals.

Interlocking Action

Transnational crime requires a coordinated response. Examine the characteristics of transnational crime, breakdowns in internal cooperation within financial institutions that resulted in enforcement action, and the actions Chief Compliance Officers must take to ensure an effective and coordinated response within their institution.