Embracing Emerging Technologies through Capability Development

Risk is perceived to be higher when a subject area is unfamiliar, which is particularly likely for emerging technologies and products. One solution is to develop the capability of staff through training and experience, where Chief Compliance Officers can utilize partners to support upskilling and augment internal capability where required. Digital assets provide a good case study: detailed knowledge within financial institution compliance and business teams to manage risks while enabling business growth.

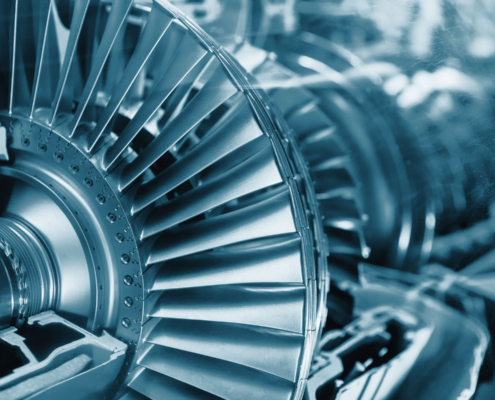

Corruption in Construction

Corruption in the construction sector can include everything from fraud, to extortion, embezzlement, and other abuses. Corruption doesn’t just undermine good governance; it endangers lives and threatens the reputation of any financial institution involved in construction projects that are rife with fraud and abuse. How can government organizations and financial institutions mitigate corruption risks when funding or supporting infrastructure projects? How can they detect suspicious transactions?

OFAC’s Compliance Guidance in Action

The Treasury Department’s Office of Foreign Assets Control (OFAC) five years ago published its Framework for OFAC Compliance Commitments. This guidance remains the most comprehensive articulation of OFAC’s compliance expectations to date. Although it notably stopped short of mandating a sanctions compliance program (SCP), recent enforcement actions demonstrate the implications of not having an SCP in place.

Corruption Kills

Construction projects are especially vulnerable to corruption because of their complexity, high price tags, and the number of intermediaries and other parties involved. Corruption in the construction sector does not merely result in financial losses, environmental destruction, and inequality, but it can also result in loss of life.

FinCEN Issues Warning to Financial Institutions

Iran continues to explore techniques that allow it to move funds to terrorist proxy groups in its efforts to destabilize the Middle East and project power by supporting the global operations of dangerous militias, proliferation of weapons, and malicious cyber activities. Financial institutions must be increasingly vigilant in detecting illicit transactions linked to Iran-backed terrorist organizations. Regulators have providing guidance, including red flags, and highlighting methodologies used by terrorist groups to raise funds.

Tech vs. Corruption

As corruption continues to pose significant challenges across various sectors, including government agencies, traditional banking institutions, and designated non-financial businesses and professionals (DNFBPs), innovative technological solutions are proving to be essential in combating these issues. This article highlights how blockchain, AI, and data analytics are revolutionizing the fight against corruption.

Types of Sanctions – A Vast and Varying Landscape

/

0 Comments

In the United States, most sanctions programs combine multiple types of designations that vary across multiple dimensions. U.S. designations are constantly changing, and more individuals, entities, vessels, and aircraft are being added to OFAC’s sanctions list. Explore the five primary types of sanctions in our latest article.