Following the Illicit Funds

As crypto grows, so does regulatory oversight. From SARs and CTRs to MSB registration and potential FBAR requirements, crypto businesses are now firmly within the scope of financial regulations.

Blind Spots in the System

When transaction monitoring fails, the cost goes far beyond fines. This article explores why many programs still miss critical red flags and how effective training helps teams to strengthen detection, calibration, and oversight where it matters most.

Top 10: Cartel Finance & Chinese Money Laundering Networks

The Institute for Financial Integrity has identified the “Top 10” list of actionable resources for financial institutions to use to detect and respond to cartel finance and CMLNs. These can inform policies, processes, systems, controls, and training programs.

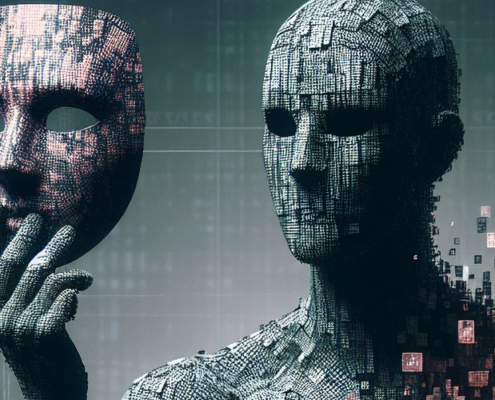

Synthetic Identities

Fraud generates billions in proceeds every year, and the use of AI significantly increases the speed, scale, and likelihood of success. Synthetic identities are already leveraged to open accounts used to commit fraud and launder money. Explore red flags and actions financial institutions must take to detect and respond to AI-enabled synthetic identities.

December 2025 Monthly Sanctions and Export Controls Report

Explore this month’s Sanctions and Export Controls Update, highlighting IFI’s take on key developments from December 2025.