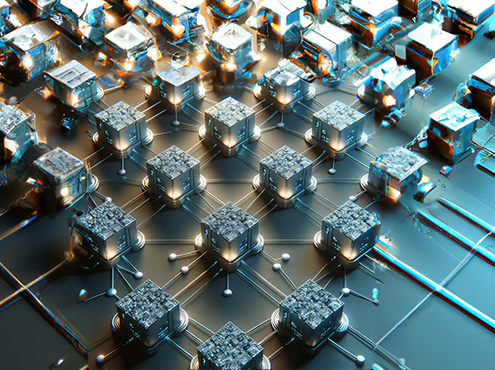

Interlocking Action

Transnational crime requires a coordinated response. Examine the characteristics of transnational crime, breakdowns in internal cooperation within financial institutions that resulted in enforcement action, and the actions Chief Compliance Officers must take to ensure an effective and coordinated response within their institution.

https://live-black-pebble.pantheonsite.io/wp-content/uploads/2023/12/GIFI-Placeholder2.png

0

0

IFI

https://live-black-pebble.pantheonsite.io/wp-content/uploads/2023/12/GIFI-Placeholder2.png

IFI2025-02-26 08:00:012025-03-26 20:26:36IFI Releases Certified Financial Integrity Professional (CFIP) Certification to Help Safeguard Financial System from Illicit Use

https://live-black-pebble.pantheonsite.io/wp-content/uploads/2023/12/GIFI-Placeholder2.png

0

0

IFI

https://live-black-pebble.pantheonsite.io/wp-content/uploads/2023/12/GIFI-Placeholder2.png

IFI2025-02-26 08:00:012025-03-26 20:26:36IFI Releases Certified Financial Integrity Professional (CFIP) Certification to Help Safeguard Financial System from Illicit Use

The Heat is On

Explore the key insights and implications from Transparency International’s 2024 Corruption Perceptions Index.

Lighting Up the Darknet

The validity of blockchain analytics technology was assessed in the Bitcoin Fog money laundering trial. What lessons does the Court’s reasoning have for Chief Compliance Officer using blockchain analytics and other decision support technologies?

Walking the Sanctions Tightrope

In today’s fast-evolving regulatory landscape, sanctions compliance can feel like an uphill battle. This guide explores the key challenges compliance officers face—ranging from multi-jurisdictional rules to cryptocurrency complexities—and offers practical tips to stay ahead.

The New Counter-Illicit Finance Regime

/

0 Comments

The convergence of AML/CFT and sanctions regimes has led to a paradigm shift. These disciplines may now be viewed as overlapping parts of a broader global counter-illicit finance regime.

Examining Evasion

Explore three recent examples with Russia, Iran, and North Korea, which represent some of the most common methods illicit actors have embraced to evade sanctions. Understanding them is an important starting point for private sector firms in assessing and responding to their exposure.

Wicked Games

Casinos are a convenient money-laundering venue. Discover effective strategies gaming venues can use to structure a robust AML compliance program and avoid being exploited by illicit actors.